Hi,

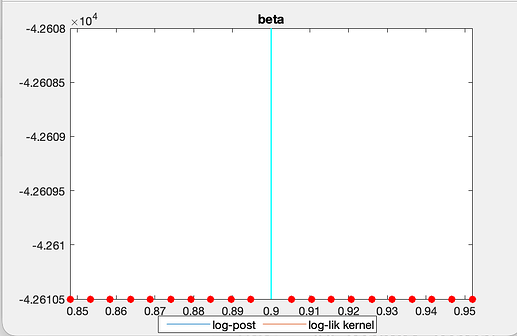

I am teaching a basic DSGE modeling class that aims that students are able to build and modify basic dsge models. In the last section of the course I am teaching a very hands on section on estimation. I got a basic NKSOE from the website of Valerio Nispi Landi, which I modify to have calvo pricing. I am trying to estimate the model using data that the Central Bank of Chile uses to estimate its large size DSGE model, however, I have found it very difficult to even find the mode. I started really small, only trying to estimate one parameter (beta) and adding (or alternating) observed series one by one, but I get red dots all around. I have read that it might be due to hitting the bounds of the parameter, but it does not seem the reason in this case. I checked model_diagnostic and the calibrated model does not seem to have any problem.

I used “beta, 0.9, , ,beta_pdf, 0.9, 0.01;” for this parameter. Something similar occurs with delta.

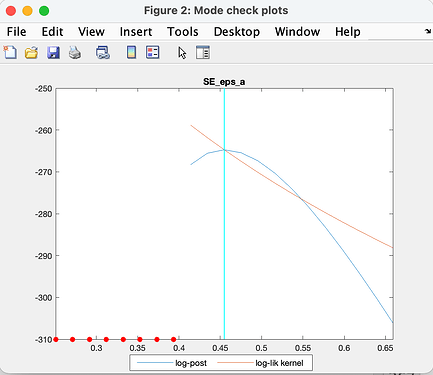

Then I tried to estimated the standard deviation of the shocks, but it is also giving problems. The following graph presents the productivity shock of a Cobb Douglas production function. Although in this case it finds the mode, it also shows some red dots that I don’t know how to interpret.

I have uploaded the files used in the estimation. The file contains a lot commented lines because of all the iterations.

data_XMAS_17Q2.xlsx (298.8 KB)

nk_open2.mod (9.7 KB)