Hello.

I’m a novice in DSGE. But, I’m building the model through lots of trials and errors.

Despite your simple answers, they will be helpful for me.

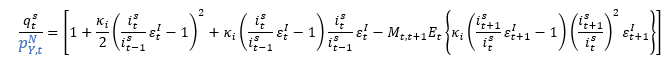

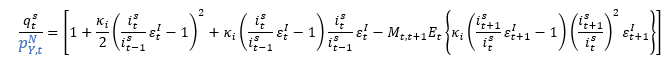

Especially, I have questions about the quadratic investment adjustment costs above.

The first one is an equilibrium condition for quadratic investment adjustment costs.

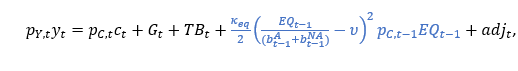

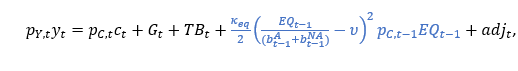

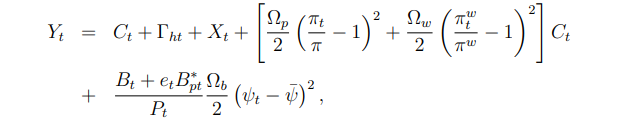

and the second one is a market clearing condition which includes the bank capital adjustment costs (Here quadratic investment adjustment costs are included in the “adj” term).

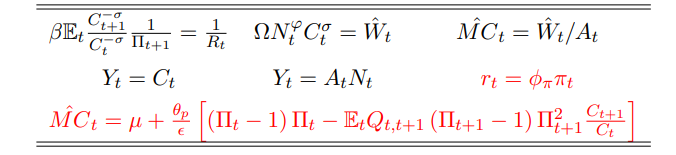

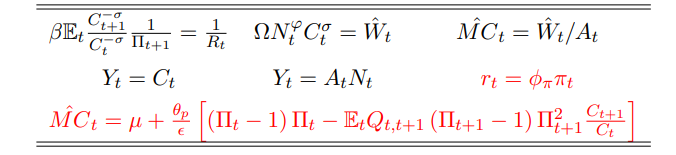

In IRFs of “dynare” package, the quadratic terms will be dropped out.

I want to know whether the IRFs (based on dropped quadratic terms) are acceptable in the paper of the journal?

I mean that in many papers, they used quadratic adjustment costs and showed IRFs through “dynare”.

So, my questions are:

Whether the IRFs (based on dropped quadratic terms) are acceptable in the paper of the journal?

Do the IRFs (based on dropped quadratic terms) not matter?

If so, why?

Actually, at first, I added quadratic adjustment costs and I’m now dropping them in the model.

I am not sure I understand your point. Quadratic adjustement costs are indeed zero up to first order. So they will drop from the resource constraint. But that does not mean they do not play a role. You can verify that in the first order condition the quadratic adjustment costs cause non-zero terms. So they will materially affect the adjustment dynamics.

Thanks! Professor! I got what your point is!

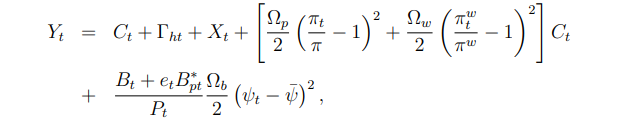

For the first equation,the last two terms are adjust costs for price and wage stickness, and bond portfolio ,respectively.But in some papers ,the market clearing condition does not include such adjust costs(see the second equation).I am very confused about it.

Without specific references, this is impossible to tell.

Capital Controls.pdf (560.6 KB)

Thanks for your reply. Please have a look at these two papers.The second paper is very long, but you may only see the pages from between 152 and 165.

Understanding DSGE Models_Costa Junior (2016).pdf (1.6 MB)

Where exactly do you think there are problems? The investment adjustment costs are subtracted from capital, not output. Thus, they do not show up in the resource constraint.

Thank you ! Now I got it.