Hello  , I am trying to replicate a simplified version of Christensen and Dib (2008), and I believe I had done it as accurately as I could.

, I am trying to replicate a simplified version of Christensen and Dib (2008), and I believe I had done it as accurately as I could.

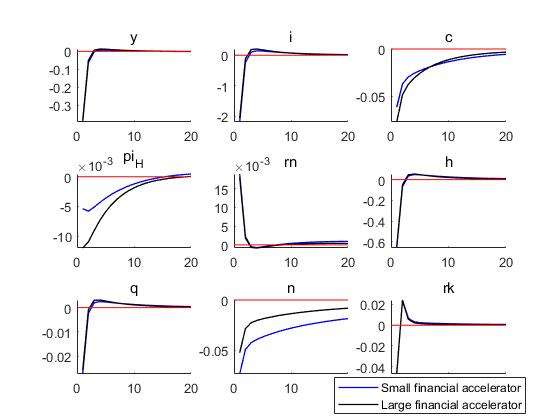

But a problem is: when I increase the financial accelerator parameter “u” (which determines whether there is financial accelerator), the IRFs of monertary shock become more stable, which go against result of the Christensen and Dib (2008). Can someone tell me why and how to fix it  ?

?

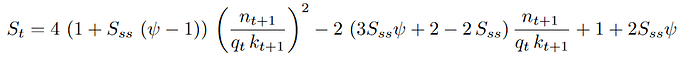

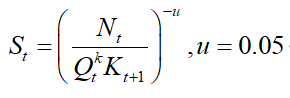

I guess the reason may be this: My model is nolinear. It means when “u” is increased, the calibrated steady state of some other variable is also changed. Then this variable’s changed steady state will work against “u” 's accelerator effect and make the model more stable to shocks.

Maybe this is why there is only linear code of Christensen and Dib (2008) (as in linear version, the steady states of variables is all zero, and will not be affected by paremeters) .

.

Below is my code and model, Please help  !

!

model.pdf (76.0 KB)

BGG_myself_log_form.mod (4.2 KB)

test_of_FA.m (1.3 KB)

You can directly run the test_of_FA.m to get the follow result. As you can see, when u is larger, output, net worth and other variables become more stable, but cosumption becomes more fluctuant.

Many thanks for your help!

Zhang Zhanpei

.

.