Dear all,

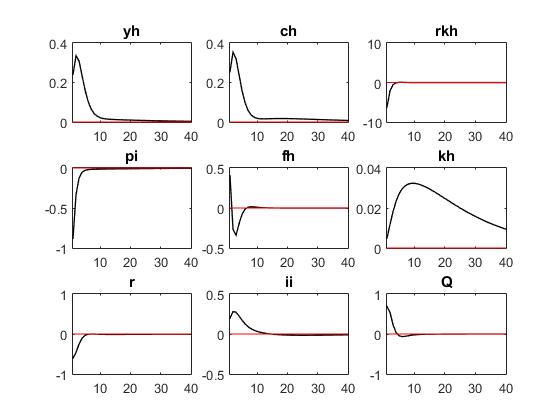

I built a DSGE model containing financial accelerator. Refer to Christensen and Dib (2008) and MMB US_CD08 code. When the financial accelerator factor is equal to 0(pssiH=0),meaning there is no financial accelerator effect.,the IRFs of technology shock looks right. pssiH0.mod (5.8 KB)

pssiH0.mod (5.8 KB)

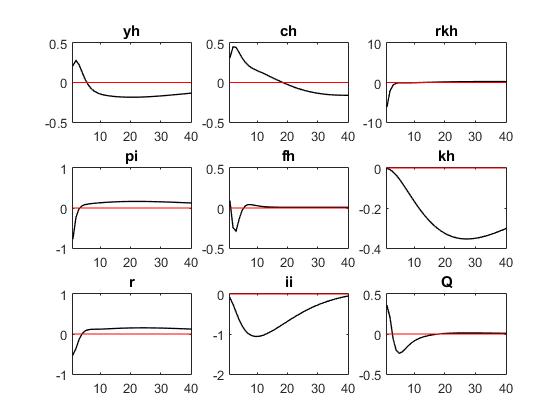

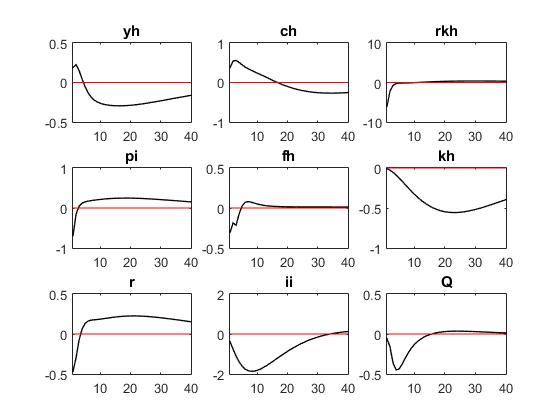

When the financial accelerator factor is set to 0.05(pssiH=0.05) and 0.1(pssiH=0.1),the IRFs of technology shock looks not good.

pssiH01.mod (5.8 KB)

pssiH01.mod (5.8 KB)

pssiH01.mod (5.8 KB)

The IRFs of capital (kh) and investment (ii) are very strange. Under the impact of technology shocks, they should Increase ,not be reduced.

I am a beginner. I checked the model repeatedly and could not find any problems.Can someone help me? Thanks in advance.