Hi,

In the sixth page of Iacoviello (2014), when setting the banking sector, the current deposit income paid by banks to residents is R_{H,t-1}D_{t-1}, while the current loan income obtained by banks from enterprises is R_{E,t}D_{t-1}. The subscript of the loan interest rate is t, and the subscript of the deposit interest rate is t-1; I did not pay attention to this at first. When I modeled and learned from Iacoviello’s model, the enterprise loan interest rate I used for modeling was R_{E,t-1}, it turns out that :there are 17 eigenvalue(s) larger than 1 in modulus for 16 forward-looking variable(s),and the rank condition ISN’T verified!.

When I changed the loan rate from R_{E,t-1} to R_{E,t}, the model worked fine. I would like to know what is the basis and reference for the selection of time subscripts of variables in DSGE modeling, and why it can only be run in Dynare when the subscripts of deposit interest rates and loan interest rates are inconsistent.

I would like to know the reason for the above issue of time subscript changes in interest rate.

Thanks!

Dynare’s timing convention for states is documented in the manual. It should coincide with the notation in the original paper. The timing in the paper is not inconsistent, but rather reflects the assumptions made. The interest rate on deposits is agreed upon in advance, while the return on loans is not.

Thanks for your reply.

I have a question which have confused me for a long time. How did Lacoviello came out the deposit interest rate is set advance, while loan interest rate is not, so that he set the deposit interest rate as RH,t−1Dt−1,and loan interest rate as RE,tDt−1?

Or more specifically, from a modeling perspective, among deposit interest rates, corporate loan interest rates and government loan interest rates, how should we determine which kind of rates are set in the previous period, and which ones are given in the current period?

Thanks for your time and I really hope to get your precious opinion.

These are assumptions made by the modeler. Most loan rates are agreed upon in advance. If you sell a bond with a promised coupons, you know the nominal return today. In contrast, if something is risky, you only know the return in expectations.

Thank you for your reply, I will think about it again.

Dear professor, with this kind of setup, however, if sum the budget constraints of agencies, there will be some terms can not cancel associated with RE,t−1 and RE,t, Total output equation will contain thses terms.Is it something we need to worry?

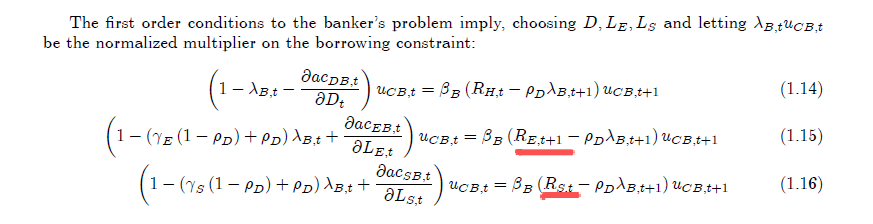

I also download the Technical Appendix for Financial Business Cycles. However, the timeing of interest rates in first order conditions is also confusing, see below 1.15 and 1.16.

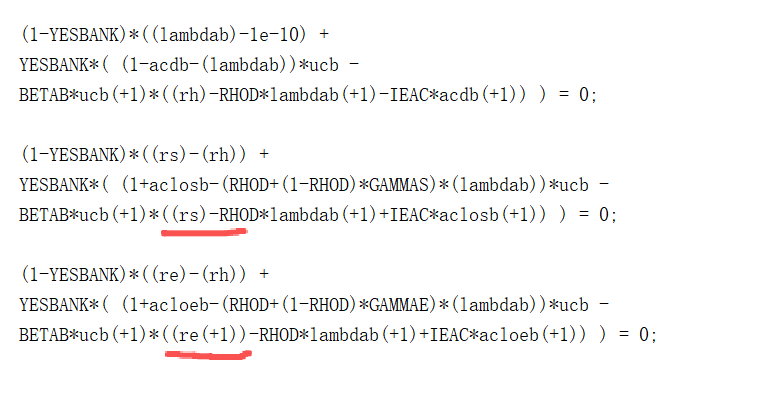

My model is also built on Iacoviello (2015) and is the same as this author. Without bank sector, it can run well while with bank sector like Iacoviello (2015) ,the rank condition ISN’T verified for one less forward-looking variables.

I really do not know why including the bank sector has such a power?

You can see from the screenshot that choosing the correct timing is not straightforward. Such a timing error will immediately flip a root and violate the Blanchard-Kahn conditions.

Thank you for your reply, professor.

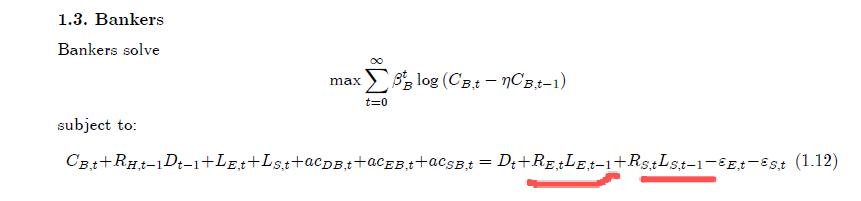

The problem is the constraint of the bank in the paper is as below:

The interest rate timing of loans to household borrowers (which is LS,t-1 in 1.12) is also RS,t, while in the first order conditions below, it remains RS,t, should it be RS,t+1?, just the same as the interest rate timing of loans to entrepreneurs?

If we built on Iacoviello (2015) with bank sector and choose timing of interest rate just as RS,t-1 and RE,t-1 and consider no risks, the rank condition ISN’T verified for one less forward-looking variables. If with no bank sector and choose interest rate of S,t-1 and RE,t-1 the same as the deposit rate (as no profit), the model can run! I do not know why we can not set banking sector like straightforward (no risks and just set interest rate timing to S,t-1 and RE,t-1), maybe because bank always obtain profits and cause a explosive problem?

That is what confusing me. If we do the same as Iacoviello (2015), however, as above, why we do not change the timing of RS,t in the first order condition? If change it to RS,t+1, Blanchard-Kahn condition will violate for one more forward-looking variable。

Hope you can help me understand this problem.

Always appreciate!

Dear, professor, in equation 1.16, can you check if the first condition assciated the interest rate payment to impatient household’s loan should be RS, t+1 as well???

Yes, from what I can see, it must be R_{E,t+1} and R_{S,t+1} in the Euler equations.

Thank you for your reply, professor.

If it is RE,t+1 and RS,t+1, I think the Blanchard-Kahn condition will violate for one more forward-looking variable. Is this right?

Models like Iacoviello (2015) with no risks and just set interest rate timing to RS,t-1 and RE,t-1 as normal violates the BK condition for one less forward-looking variable. In other words, the model dynamics have explosive mechanism!

I really do not know what is the right form of models like Iacoviello (2015) with bank sector. I can only make the model run with no bank sector at all and set interest rates of RS,t-1 and RE,t-1 the same as the deposit interest rate (as no profit).

I always appreciate for your help.

I am wandering where the explosive behavior comes from in models like Iacoviello (2015) with bank sector…Maybe the capital adequacy constraint?or the maximization problem should use net worth instead of consumption? or maybe some variable of bank sector (consumption, loans or deposit?) can not return back to the steady state?

Do you have some instuition on these problems? Thanke you so much, professor.

I haven’t worked with these models. I suggest to have a look at the replication files to see what the correct timing is. Importantly, the timing needs to be consistent throughout the whole model, not just the Euler equations.

Thank you for your reply, professor.

I download the replication files from Iacoviello’s homepage and find he only set the interest rate timing of loans to enterprises as RE,t+1 while keeping interest rate timing of loans to impatient household as RS,t!

I just want to figure out the reason of BK condition for one less forward-looking variable in models like Iacoviello (2015), but now I think maybe I cant not.

I always appreciate for your help, professor.

I want confirm one more thing that in bank sector, with or without adjustment costs can affect the BK condition? I remeber adjustment cost just kills unit root, right?

So if I have one model with no portfolio adjustment cost, the model can not run for violating BK condition. If I add portfolio adjustment cost, violating BK condition just remains and the model still can not run, right?

Thank you so much professor!

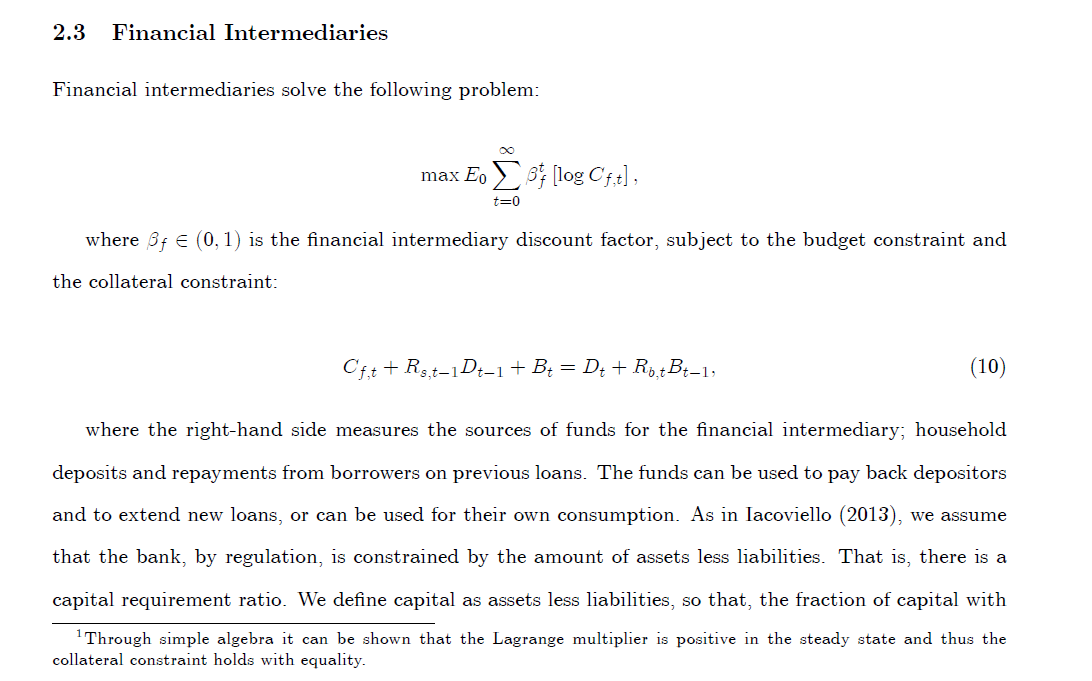

Dear, professor. I want to ask you one question which confused me for a long time. Hope you can have time to reply, thank you in advanve.

In papers with bank sector and set like below:

Bt denotes the loan. A banker try to maximise consumpiton.

Why the timing of interest rate always set as Rb,t instead of Rb,t-1 as normal.

I think if set Rb,t-1, all these models come to the same problem for violating BK condition of no stable equilibrium.

I think marginal consumtion utility or Lagrange Multiplier has timing t+1 in the first order condition which made these models violating BK condition of no stable equilibrium. They just made the model run by set the interest rate timing one period forward.

I think the truth problem is an inside explosive merchanism about forward consumption t+1, not interest rate.

But I can not figure out about this. In the simple model as above, do you have some instuitions? Thanke you so much, professor.

Timing of the interest rate should depend on whether it can be affected by shocks happening at time t or only reacted to the ones in t-1 (i.e. whether it is predetermined). But is generally possible (e.g. bonds vs. capital). What the correct timing is depends on the particular model. Usually, there is a unique correct timing that satisfies the BK conditions.

That being said, sometimes even published papers have mistakes where they “fix” the timing by introducing a second timing mistake.

Thank you for your reply, professor, always appreciate for your help.

Considering the risk in Iacoviello (2015), I think set interest rate timing to time t is OK for me. while there have two different loan interest rates in the model, i.e. RE,t and RS,t. They only set the timing of loans to enterprises as RE,t while keeping interest rate timing of loans to impatient household as RS,t-1.

I think the two different interest rates should have the same timing as the similar construction. The reason they only set one interest rate timing as time t, I guess, is they just met the same problem with me and the author in this post, i.e. If we built on Iacoviello (2015) with bank sector and choose timing of interest rates as RS,t-1 and RE,t-1 and consider no risks, the rank condition ISN’T verified for just one less forward-looking variable.

I hope someone can help me in the near future understand why, why the model has no stable equilibrium with bank sector choose timing of interest rate just as RS,t-1 and RE,t-1.(I am pretty sure the problem is in bank sector, as I delete the bank sector, the model runs well)

Thank you again, professor.