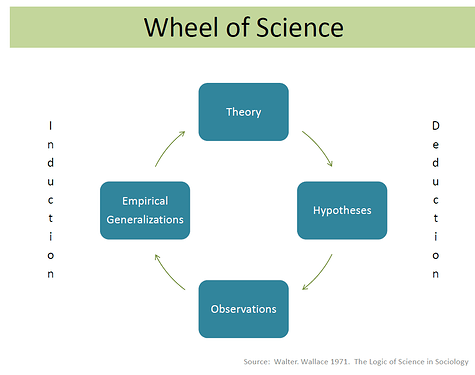

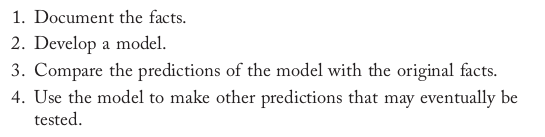

Facts or evidence I guess is summarizing the data using simple statistics, maybe. Like first moments, second moments, correlations, autocorrelations, big ratios, etc. I read a book that gave these steps to macroeconomic research.

I am reading Jordi Gali (2015) and he seems to be following this approach. But what he calls ‘evidence’ appears to be the results of a VAR model in chapter 1.

My questions

-

So it appears the VAR model could be used both as a data analysis tool in the first stage (i.e., Documenting the facts) in DSGE modeling, and also sometimes in the second stage (i.e., Developing a model) in macroeconomic modeling in general?

-

And secondly, should we take Jordi’s conclusions as universal truths? Maybe not, I guess. For example, predictions of the classical monetary model in chapter 2 may not fit US data, but we can’t generalize that to all economies, right? If those predictions fit data for other economies, then we can still say the classical monetary model is good, right? Although not good for US data.

Thanks!