Dear all

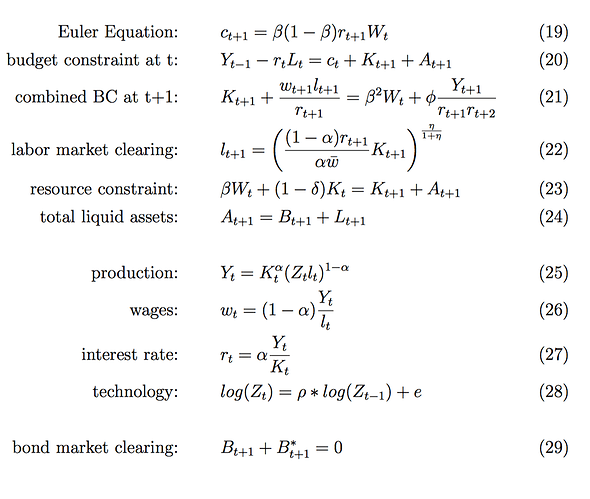

I have a two country model where one country is a small open economy (takes the interest rate as given).

I have now 22 equations for 21 unknowns and leave away the bond market clearing B + B* = 0.

By Walras’ Law the bond market should also clear but if I compute the steady state it doesn’t. Any idea?

Best Regards

I am not sure I am following. Is

B + B* = 0

one bond market clearing condition, or is it two conditions, one for foreign and domestic bonds. Because your condition only specifies a linear combination to be 0. It does not pin down the values individually.

1 Like

It’s the bond market clearing condition. B* is for the second country and all other equations also apply to this second country. The bond market now always clears through the world interest rate, the model is working now, thanks for your help. My error was to set wages and interest rate to the marginal product, which was not the case in this model.