Hello, @jpfeifer!

I have a question regarding the following. The structure of my model is as follows:

Households interact with the production sector in two main ways. On one hand, they supply labor to intermediate firms, and on the other hand, they act as creditors by providing one-period intertemporal loans used by firms to finance investment. In addition, households consume by purchasing final goods from final goods producers.

In the external sector, interaction takes place through the sale of bonds and the subsequent payment of interest on them. The central bank sets the nominal interest rate.

The production side of the model is divided into several subsectors: the intermediate goods sector, the imported goods sector, the aggregation sectors for both intermediate and imported goods, and the final goods production sector.

Intermediate goods producers interact with households through labor payments and profit distribution. The intermediate goods aggregator combines different intermediate products into a single composite good. Intermediate firms own capital and make decisions about its accumulation. Their behavior is subject to an intertemporal budget constraint, which assumes that investment is fully financed by the issuance of new one-period debt borrowed from households.

The imported goods sector purchases goods from the foreign sector and sells them to final goods producers. The imported goods aggregator, similar to the intermediate goods aggregator, transforms imported goods into a single composite product. Finally, the final goods production sector uses aggregated intermediate and imported goods to produce a single final good, which satisfies both consumption and investment demand in the economy.

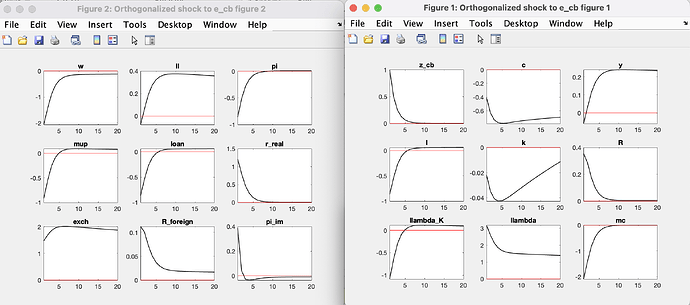

When I analyze a shock in the form of an increase in the interest rate, I observe that the exchange rate (exch) rises in response, even though it should fall – that is, the domestic currency should appreciate. Could you please advise whether this indicates that I am making a mistake in the model?