Hi everyone

I have a couestion about the Costly State Verification (CSV) models.Thank you for your help

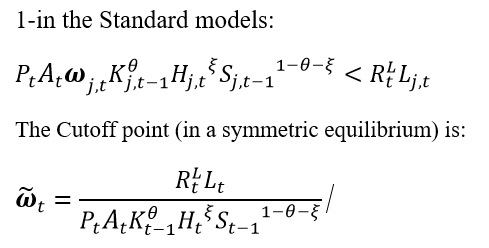

In the Costly State Verification (CSV) models, we determine the Cutoff point of default as follows:

producer j declares default in period t if its revenue after the realization of the idiosyncratic productivity shock is not high enough to cover the borrowing cost. Consequently, default occurs if:

A is an Aggregate productivity shock,ω is idiosyncratic productivity shock, K is capital,H is labor and S is inventories

My question is for the case that I want to make changes:

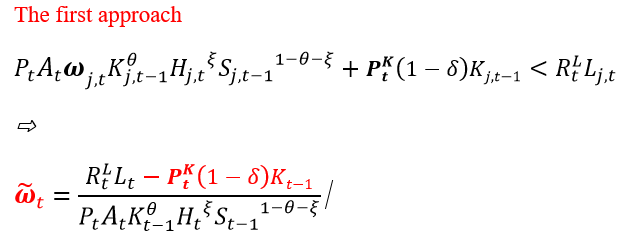

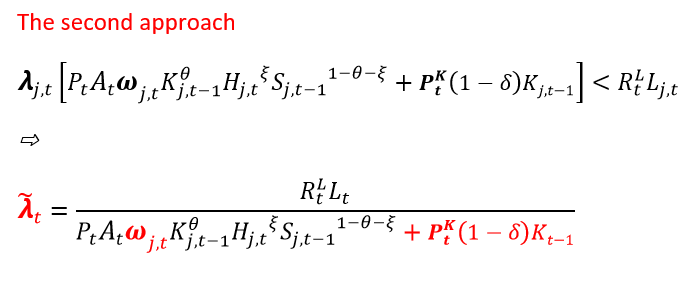

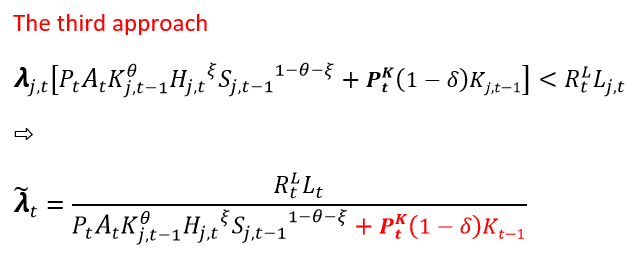

if we assume that the firm buys (not rent) capital from the capital good producers and therefore owns the capital, Also, contract between the firm and the bank is such that both his production (Or sale) and his undepreciated capital are considered for loan repayment. In this case, what is the Cutoff point of default? The first approach or the second approach or the third approach?

Is the first approach correct or should the idiosyncratic shock be considered for production (Or sale) plus undepreciated capital) (The third approach)?