Dear all,

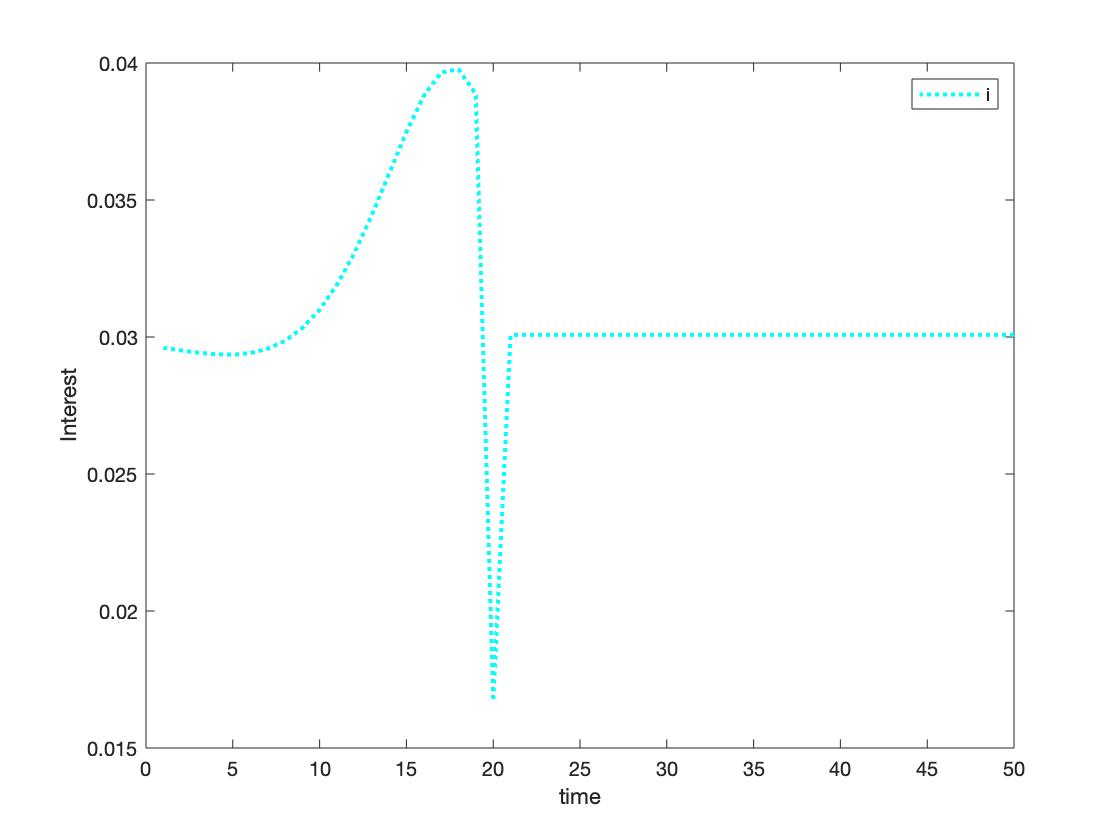

I was trying to implement a forward guidance shock on the 20th period but the policy rate start increasing around the 15th period instead of only dropping at the 20th - as shown in the picture. I know that implementing a policy rate as r=r_nat+nu will give me the desired downward pick in the 20th but I was wondering if it was possible to have the same image also with a taylor rule.

Thank you for your help.

Best,

Maria Ludovica Ambrosino

France.m (1.1 KB) France.mod (5.3 KB)

Dear Ludovica,

If I have understood correctly, you would like an interest rate moving only since period 15 on. However, given that agents anticipate the shock, inflation and output move and this triggers the Taylor rule before the shock materializes.

What you can do is to specify the rule like this:

i=i_ss+nu;

In this case you violate the Taylor principle, because chi_pi is lower than 1: the BK conditions are not satisfied. However, you may still be able to solve the model in perfect foresights, as you are currently doing. I tried, and you can solve the model if the shock is positive. If the shock is negative, Dynare is not able to find a solution, maybe @jpfeifer can help you here.

A couple of suggestions:

-

An interest rate shock of 0.02 is pretty big, you may want to try with a shock around 25 basis points.

-

Call the .m file differently from the .mod file: when you run the .mod file, Dynare usually creates an .m file with the same name of your .mod file.

Valerio

France.mod (5.3 KB)

Dear Valerio,

thank you for your suggestions, always super useful!

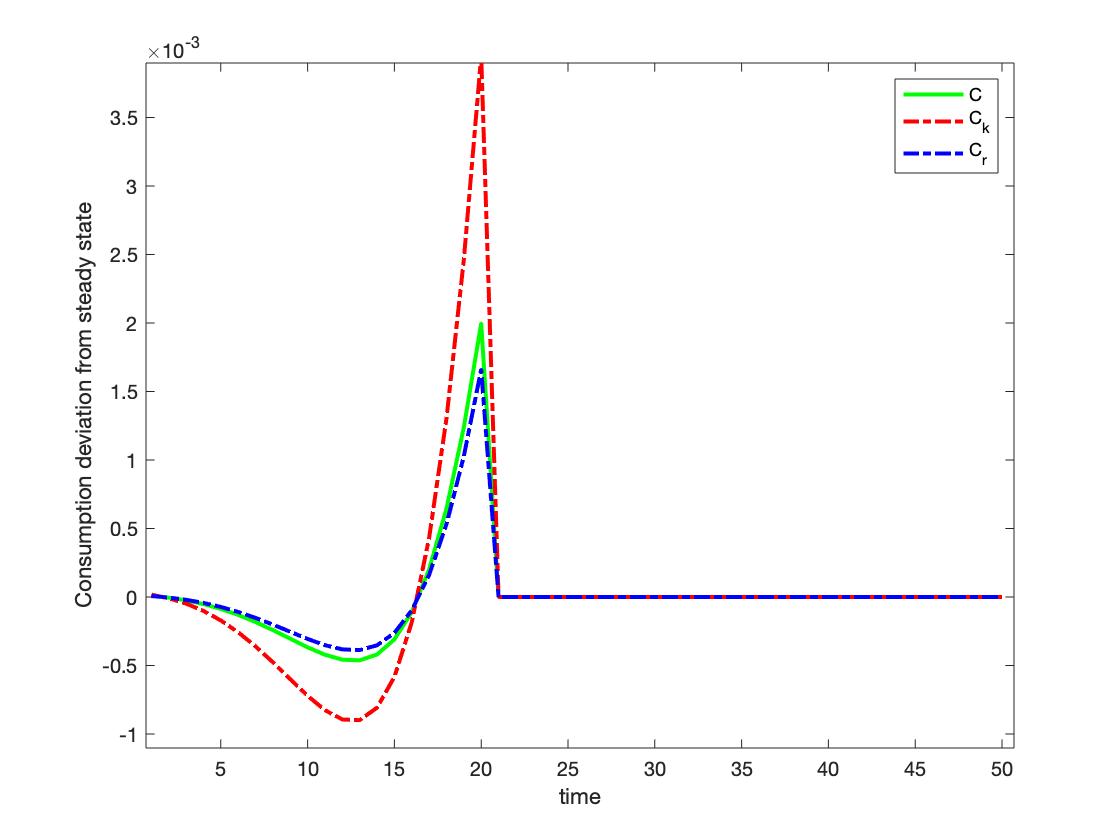

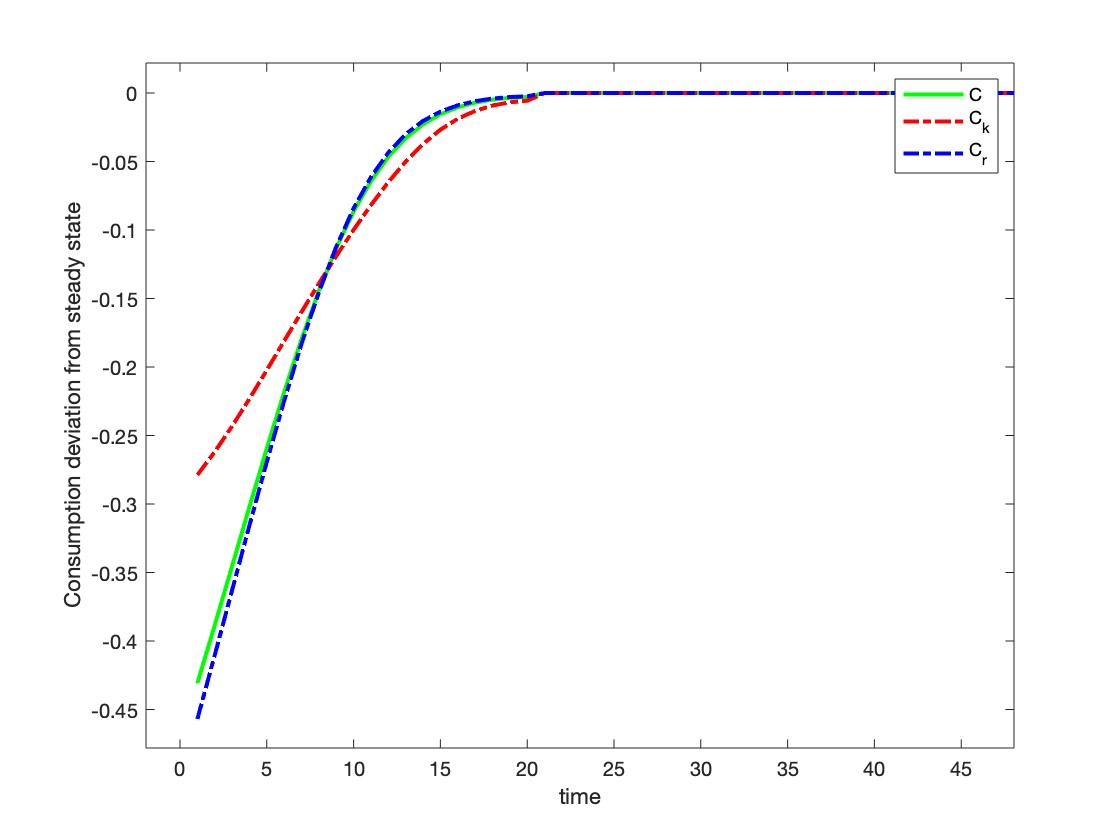

I tried the mod file you attached, and using i=i_ss+nu makes the consumption reacts immediately and substantially to the shock (figure 1) - as following the forward guidance puzzle - whilst the taylor rule allows a smoother and smaller response in time (figure 2). So I was thinking that the second rule would give a more realistic response. However, the taylor rule also allows for the interest rate to increase before the 20th period, as agent anticipates (figure in the previous post). So, I was wondering if there was a way around that upward spike showed in that image, or if that is a byproduct of the rule I have to keep.

Thanks again for your time!

Ludovica

For my understanding, forward guidance means announcing the future paths of interest rates, so I prefer the option of shutting down the Taylor rule. If this implies weird impulse responses it is up to the researcher either to defend the model, to amend it or to highlight the puzzle. I am not an expert in this literature, but I guess that you obtain this big increase in C in period 20, because the real interest rate is lower. Maybe you could try with a more persistent FW guidance shock (interest rate = shock for more than one period), it would be more realistic.

2 Likes

I am not sure I understand the problem. What is the experiment you have in mind? Usually, FG implies pegging the interest rate for a number of fixed periods before reverting to a rule. You seem to have a particular shock in mind at some point in time, but keeping the interest rate rule for all periods at the same time. This will of course allow for endogenous responses.

Thanks to the both of you @valerio88 @jpfeifer .

My experiment would be central bank promising a decrease of 1% in the interest rate 20 periods from now (similar to McKay et al. 2015). But I understand now that in a forward looking model the response of the taylor rule would be the one showed in the first picture, so I guess I’ll have to change the type of shock/persistence if I want a different movement in the interest rate.

Thanks again!

Ludovica

I think McKay et al. assume that the central bank targets the real interest rate outside forward guidance, so you may try a rule like this:

(1+i)/Pi(1)=(1+i_ss)+nu;

1 Like

True, but in footnote 6 they also talk about implementing it with a monetary policy rule that follows the Taylor principle. I will try this option though, thank you very much again!

Ludovica