Dear All:

I build a model based on Iacoviello 2010’s two sector DSGE model, and I introduce mortgage constraints into both the real estate sector and consumption sector based on Iacoviello 2005. So the two production sectors also contain borrowing constraints and they use capital as collateral.

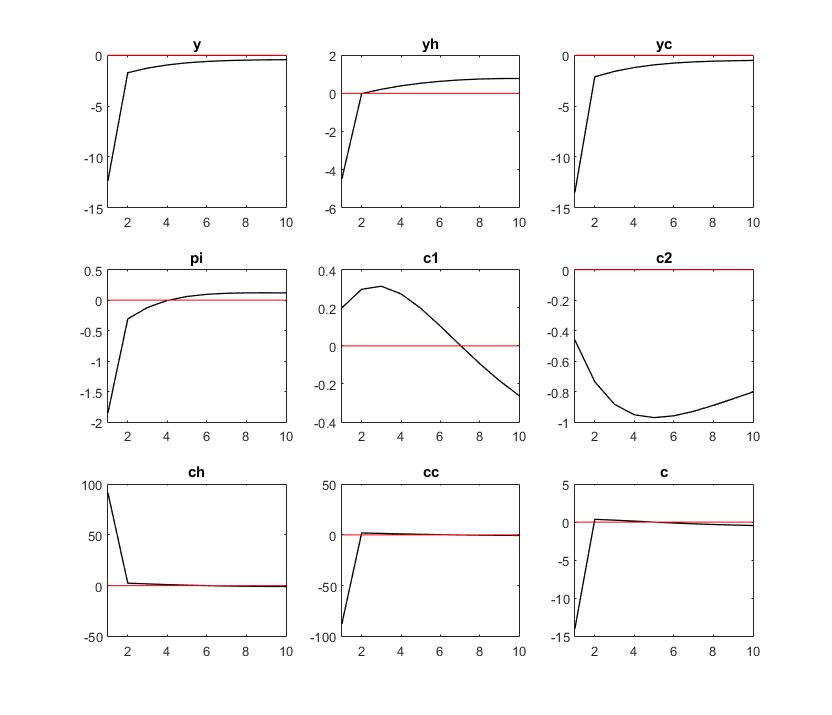

The irf result is quite strange, all the real variables (say, output, consumption, labor, inflation) respond to all shocks very Unsmoothly. I have tried to introduce consumption habit into both patient and impatient households, but it makes no help.

More strange is that bonds(bonds in impatient household, in real estate sector and in consumption sector) respond very smoothly, distinctly different from those real variables.

Why can this happen? This result has frustrated me for more than 3 weeks and I have tries to make lots of small modification but still can not figure out why. Please help!

Sincere thanks in advance.

The mod.file and 1 irf results are attached below.

God Blesses! Please help to solve the problem!