Dear Dynar community,

I am trying to replicate the paper of Gawthorpe, K. (2019). which in turn is based on Aliyev, I., Bobková, B., & Štork, Z. (2014) on the NK SOE model of the Czech economy.

The model presented in the papers incorporates price and wage rigidities, has a fiscal policy with taxes, and government consumption and can run a budget deficit, and has a monetary policy with the Taylor rule as well as other features.

The model in the paper is log-linearised, but I would like to replicate the nonlinear model instead.

In addition, I am adding material inputs to the intermediate producer’s Cobb-Douglas production function, as I want to achieve the input-output sectoral model from the paper of Gawthorpe.

I am new to DSGE, therefore I am approaching the replication of the paper step-by-step by gradually increasing the complexity of the model.

In this phase, I have the model for a closed economy, but with fiscal policy and monetary policy.

I have faced two main problems with it so far:

-

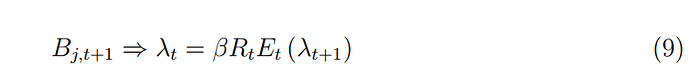

First, the model does not allow for the Euler equation of consumption to be solely determined by monetary policy rate. I studied the reason behind it and found that it requires consumption to be defined by the return on capital - otherwise, it does not reach a steady state. Incorporation of the relation of the monetary policy rate with return on capital such as \frac{R}{\Pi_{t+1}} + \text{Risk} = \frac{R_K (1 - \tau_K)}{P_K}, where R is a monetary policy rate defined by Taylor rule, Pi is inflation, R_K is a rate on capital and P_K is a price of capital and tau_k is a tax on capital did not help - due to conflict with monetary policy rule and rate on a capital equation.

In order to deal with it I employed a temporary solution - consumption depends on a rate of capital and monetary policy rate with equal weights of 0.5, but this does not solve the core problem. -

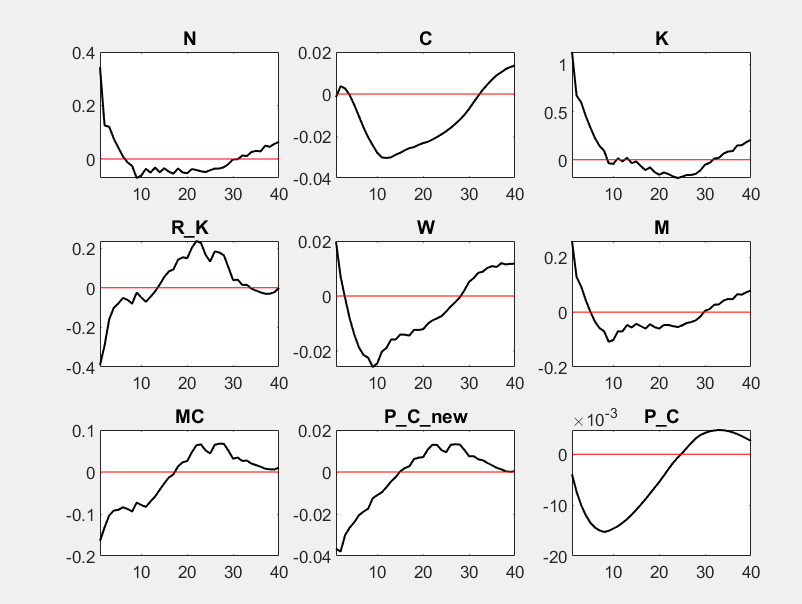

The model produces very strange IRFs:

In addition, if I change a fraction of firms that do not re-set

their prices in respective period ( ζ ) to a lower value, the model violates Blanchard & Kahn conditions. If I change the elasticity of substitution between different goods (θ) to any other value apart from 2, the model does not reach the steady state.

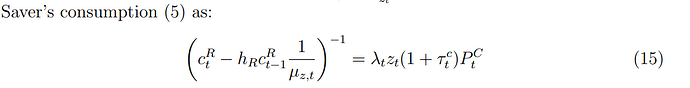

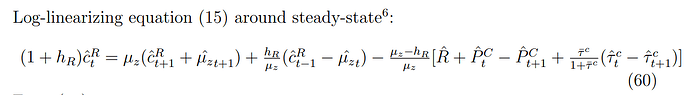

I studied the potential problem behind it and my hypothesis is that it is due to the addition of forward-looking expectations for the new price, which is set by:

, where MC is marginal costs and Y_F is a final production.

When I tried the simpler model, in which the new price is determined only by a mark-up and future marginal costs

, the model seemed to work fine (at least IRFs were appropriate).

Any help or suggestions on how to deal with these problems would be much appreciated!

Paper of Gawthorpe, K. (2019)

Czechia.pdf (1009.4 KB)

Paper of Aliyev, I., Bobková, B., & Štork, Z. (2014)

Extended-DSGE-Model-of-the-CZ-economy (1).pdf (588.4 KB)

My current model

Autarky_last.mod (3.5 KB)

Thank you in advance.