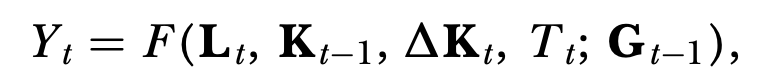

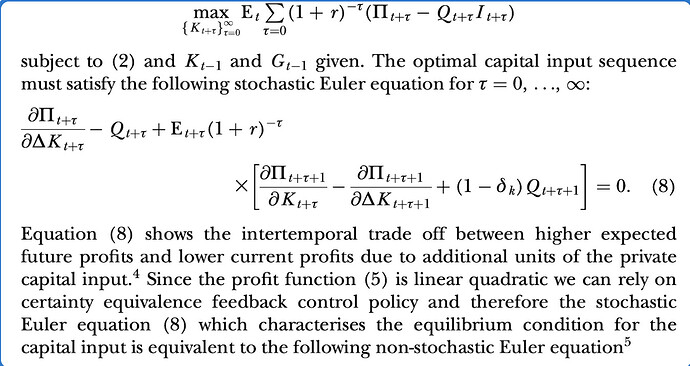

Hey everyone, can anyone help me understand the intuition behind this stochastic Euler Equation? Also, I do not get how the first derivative of the profit function with respect to change in Capital appears there, if we’re maximizing Kt+tao. Quick side note: Change in Kt + tao is the net investment, which represents “internal adjustments costs, measured as foregone output”. This is the second stage of solving a firm’s profit maximization problem (previously, L and Y optimal values were found). The production function is quasi concave in L, K and net investment.

If more context is need or this type of questions are inappropiate, please tell me. The model is presented in the following paper: Intertemporal Output and Employment Effects of Public Infrastructure Capital: Evidence from 12 OECD Economies | The Economic Journal | Oxford Academic