Dear All:

I am trying to look for Ramsey optimal policy。

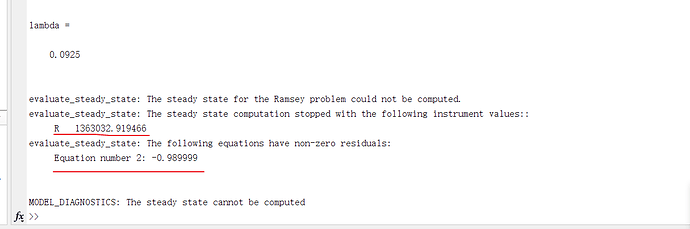

The code run successfully in Taylor rule, but if we put it in Ramsey optimal policy, it doesn’t run.

and model_diagnostics report:

The equation number 2 is:

Q=beta*(lambda(+1)/lambda)/Pi(+1);

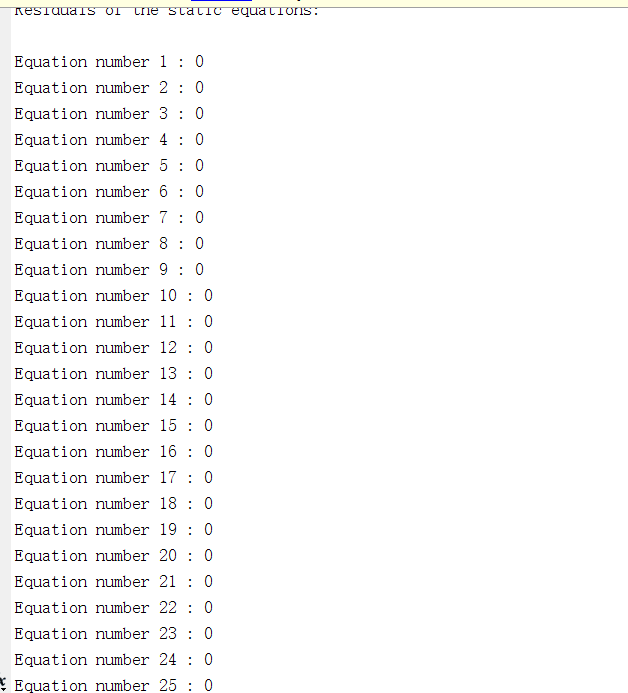

But I run resid in matlab:

all residuals of the static equations is 0.

The intrument is nominal interest rate “R”, and

initval;

R=1/beta;

end;

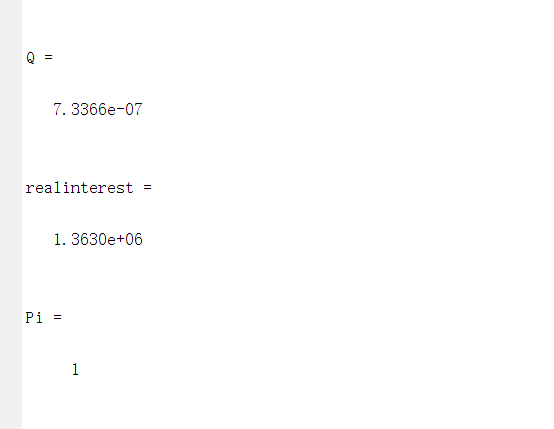

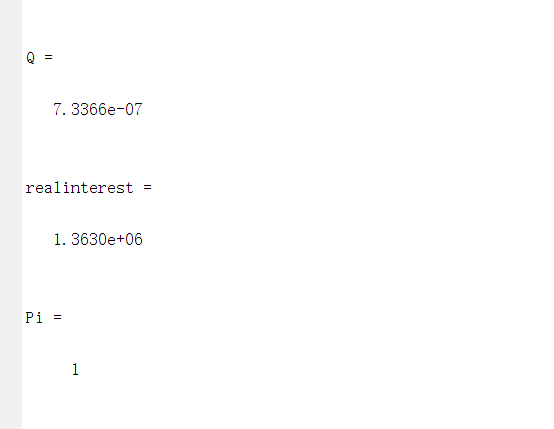

I think the problem may lie in the nominal interest rate “R”,because in steady state, the value of bond price “Q” and realinterest is very small.

I would need to see the file.

I don’t think the economic logic here is correct. If the instrument is the nominal interest rate, that usually implies that the steady state inflation rate is endogenous, because the real interest rate is determined by the discount factor. But you set Pi=1.

Thanks for your reply, Prof Pfeifer.

Following your advice, I re-written the mod file, and everything is going well. And I really understand the economic logic of Ramsey optimal policy, Thanks for your help.

I would like find the optimal simple monetary policy by looking for the value of phi_pi phi_y.

I see the documentation of the osr command. osr is only suitable for linear quadratic.

So if in nonlinear model with uncertainty, Can I use the osr command when looking for the optimal monetary policy?

If I can’t use osr, in order to get the parameters,

Do I need to write welfare_objective.m and use cmaes command as you mentioned in other posts in forum?

Thanks for your help, have a nice day!

The question is not whether the underlying model is nonlinear, but rather whether a first-order approximation to the model is sufficient (usually requiring an undistorted steady state) and whether the objective function does not include a constant term. In such cases, the osr-command will not work. You would need to write you own welfare_objective.