Dear Professor Pfeifer,

When I was reading some classic papers, I feel a little confused about the questions bellow. Would you please give me a hint ? Thank you for your time !

(1) Sometimes when doing the calibration, we may use the ratios of economic data as targets to adjust the steady states of variables in the model, e.g. C/Y, I/Y and so on. While I find it’s not quite easy to do this especially when the model is a little complicated. Is it always necessary to keep the ratios of variables’ steady states close to the ratios of practical data ?( I find that they are not so closed in some papers ) Does the calibration results impact the estimation of other parameters?

(2) In some papers, the model contains the entrepreneurs’ consumption (C_E) besides patient and impatient households’ (C_P and C_I). What does this entrepreneurs’ consumption really mean in practice (what practical data) ? Is it finally belong to the household consumption? (because the steady state of C_E is even much larger then C_P after my calibration of model, which seems so wierd. )

And also why the consumption preference shock only relates to the households’ consumption but not the entrepreneurs’ consumption ?

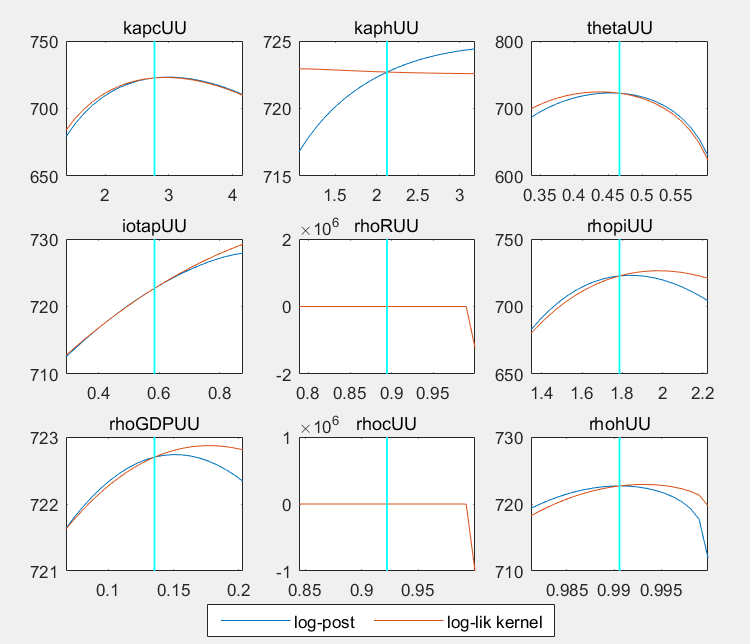

(3) I have encountered bad mode plot as attached. (all parameters are identified. ) For some parameters the vertical line is not through the peak of blue line, and even the shape like rhoRUU, rhocUU appears. What should I do to improve this ? Change the prior mean or some other way ?

Any reply will be appreciated. Thanks again !