Capital services depends on capital and u, but u depends on the rental rate, which again depends on capital services. So there might be a kind of circularity there, however, a model version without variable capital utilization means indeterminacy

- Please provide me with the version generating the problem in the

lyapunov_solver. I guess this affects Octave 4.2.1. - It cannot be that your model does not work without variable capital utilization. This indicates that there is a problem in the simpler model. You should continue dropping features from the model until it works. Did you manually eliminate capital utilization or did you just set the cost parameter to infinity? The latter often causes problems.

- Here is the model version, where r depends on ks, but which produces the error message:

model3a.mod (2.9 KB) - I eliminated capital utilization manually. In the closed economy, the model always works, independent of whether I have variable capital utilization or not. But in the open economy, only the model version with ks works.

- That is because your model has a unit root and you need to set

options_.diffuse_filter=1before calling the smoother. - Nevertheless there is a problem here. Again, please start from the simplest model that works. Your current approach is looking for a needle in a haystack.

I think that the problem comes from capital or the timing of capital or investment-related variables. When I eliminate wages and labor hours, this has no effect on the determinacy of the model. A model without capital works even in the context of an open economy. The problem introduced by capital disappears once variable capital utilization is considered, so there must be some countervailing effect of ks or u. Nevertheless, I do not want unit root behavior in my model, which might not come from the real exchange rate (because there is no unit root in open economy models without capital), but from the circularity mentioned above (ks depends on both k and u, but u depends on ks). The question is how to re-introduce capital or investment-related variables.

The most simple model that works is the canonical New Keynesian dsge linked to a similar 3-equation model with a common monetary rule and an expression for the real exchange rate. This expression and leads to an eigenvalue of 0.91.

The real exchange rate is defined as qq-qq(-1)=pif-pih+eqq-eqq(-1)

However, in a three equation version with different parameter values as well as lags of consumption and inflation, this real exchange rate leads to an eigenvalue of 1 and hence there is a unit root, with dynare being unable to conduct a shock decomposition (unless options_.diffuse_filter=1 is used).

I don’t think it’s a matter of calibration, because I have already replaced the parameter values in the model that works, and it still works, so it must be caused by the lags of endogenous variables, which appear on the right hand side of consumption and inflation or by the assumption regarding the development of the real exchange rate?

Nominal variables in the canonical New Keynesian have a unit root, regardless of the parameterization. That is normal. You would get rid of it by replacing the nominal variables by their growth rates, i.e. replacing qq-qq(-1) by e.g. dqq.

But that is not the reason your more complicated model does not solve. Having a unit root is fine, but you need to invoke the diffuse filter.

But is it also possible to estimate a model with a unit root? I thought that I have to get rid of it in any case.

Yes, that is what the diffuse Kalman filter is used for.

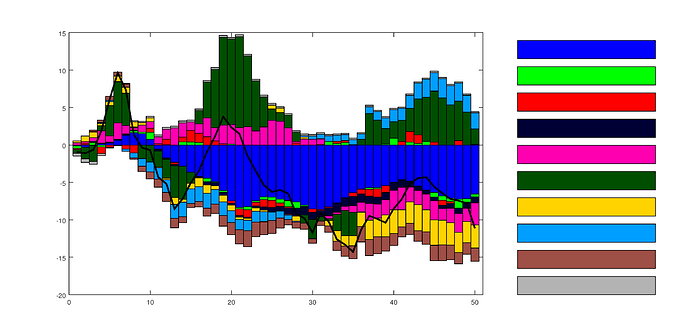

Is this graph for the historical shock decomposition of consumption using simulated data correct? My model has no unit root/collinear relationship and model_diagnostics says No obvious problems with this mod-file were detected.

What do you mean with correct? It doesn’t look too crazy, but without knowing the model and having the labeling in the figure, it is impossible to tell.