Hello, Dynare users!

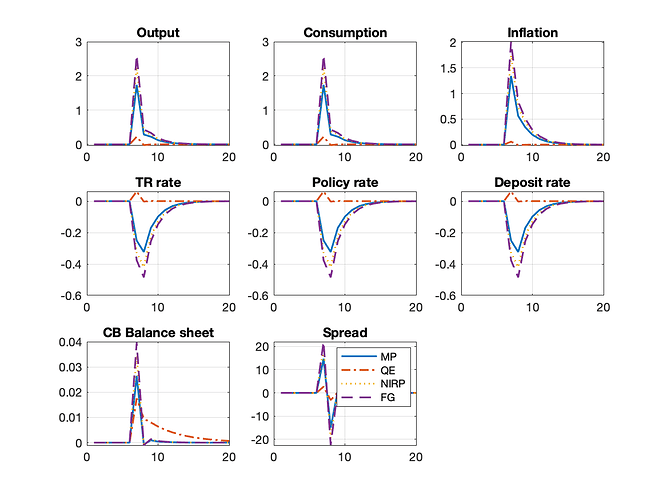

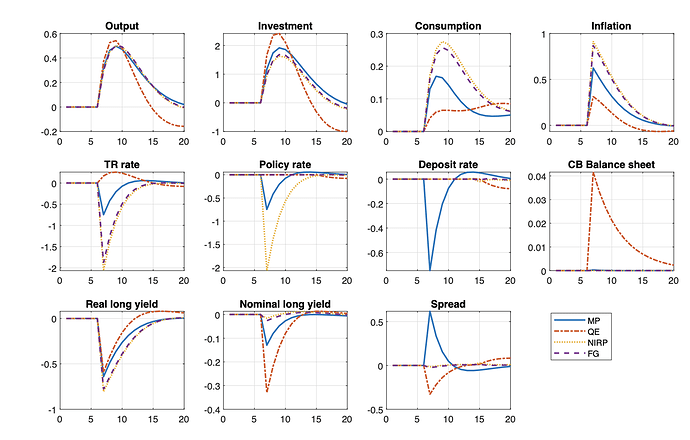

I’m trying to replicate an exercise from figure 1 of the paper by Sims and Wu (2020). I’m building on their original code, but using a slightly different model which is easier. Following the original paper, I’m generating a sequence of credit shocks to make ZLB binding and solve the model with OccBin toolkit. However, for whatever reason it seems like dynamics of policy rate, short-term rate and Taylor rule rate are completely similar after the monetary policy shock in period 7 which is not consistent with results presented in the paper.

Does anybody have an idea what might be a problem with my code?

File exogenous_mp.m is supposed to replicate Figure 1 from the paper. Original paper is attached as well.SSRN-id3344490.pdf (1.1 MB) Model_closed.zip (358.5 KB)