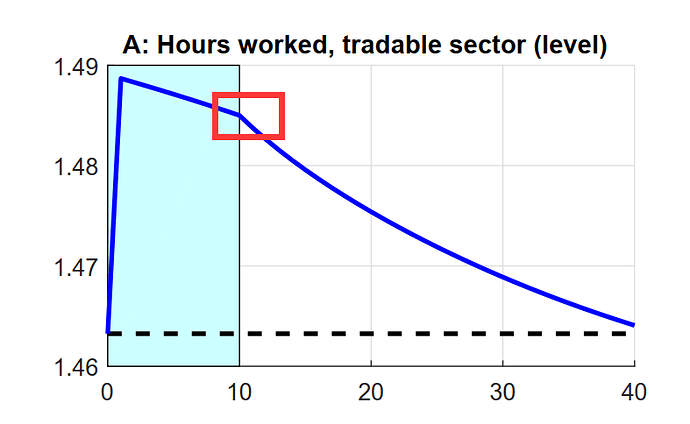

I’m reading an article from the Bank of England called the brexit vote, But when I am running the program, I can’t get the turning point given in the original text. As shown in the figure below, the impact in my program is written according to the original text, and I don’t know how the turning point in the pulse response diagram in the article comes from. And the impulse response diagram is not the same as the original. I don’t hope you can give some suggestions after reading this article on the Internet. Thank you! The original text and my code are attached below.

Your mod-file does a stochastic simulation for surprise shocks. But the experiment your are looking at is an anticipated, i.e. perfect foresight scenario.

Thank you! Professor Jpfeifer

Do you mean that we need to lag the period of impact? I put the impact lag for one period and the Blanchard Kahn condition was not satisfied, so the program could not run out.

No, I am saying that you need to use perfect_foresight_solver given the correct process for the exogenous productivity process outlined in the paper.

Dear Professor Jpfeifer

I changed the program to perfect_ foresight solver. To my understanding, the TFP shock in the tradable goods sector should be the anticipated temporary impact. I changed the program, but the impulse response diagram of endgenous varibles are always a straight line. So I would like to ask you if there is something wrong with my program. Thank you very much (6.3 KB) the-brexit-vote-productivity-growth-and-macroeconomic-adjustments-in-the-united-kingdom.pdf (1.1 MB)

Your attachement does not work.

zc.mod (6.3 KB)

Sorry,Sir.This should work

Did your simulation converge? In Dynare 4.6.1, I get a non-straight line.

Sorry! The shocks in this paper is just know its dispersion ,Why does it is a perfect foresight scenario.

What do you mean? Figure 2 clearly shows that the TFP growth change is anticipated.