I have a question.

I want to replicate chapter 11.11 Growth RMT RMT4_ch11.pdf (540.8 KB)

So I tried to succeed to making code, but it’s failure.

Could you help me?

%-----------------------------------------------------------------------------------------------

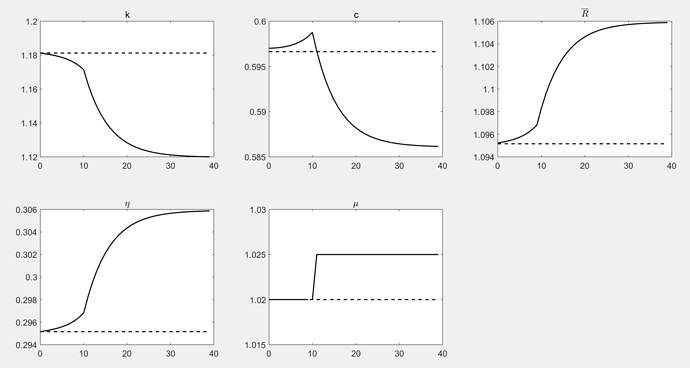

% Experiment : Permenant increase in mu at t=10

% Note:Following the discussion in the text t = 0 is the first period of the new (simulated) path

%-----------------------------------------------------------------------------------------------

// This program replicates figure 11.11.1 from chapter 11 of RMT3 by Ljungqvist and Sargent

// Dynare records the endogenous variables with the following convention.

//Say N is the number of simulations(sample)

//Index 1 : Initial values (steady sate)

//Index 2 to N+1 : N simulated values

//Index N+2 : Terminal Value (Steady State)

// Warning: we align c, k, and the taxes to exploit the dynare syntax.

//In Dynare the timing of the variable reflects the date when the variable is decided.

//For instance the capital stock for time ‘t’ is decided in time ‘t-1’(end of period).

//So a statement like k(t+1) = i(t) + (1-del)*k(t) would translate to

// k(t) = i(t) +(1-del)*k(t-1) in the code.

%-----------------------------------------------------------------------------------------------

% 1. Defining variables

%-----------------------------------------------------------------------------------------------

@#define simulation_periods=100

// Declares the endogenous variables consumption (‘c’) capital stock (‘k’) total factor productivity (‘A’);

var c k A;

// declares the exogenous variables consumption tax (‘tauc’),

// capital tax(‘tauk’), government spending(‘g’), growth rate of productivity (‘mu’)

varexo tauc tauk g mu;

parameters bet gam del alpha;

%-----------------------------------------------------------------------------------------------

% 2. Calibration and alignment convention

%-----------------------------------------------------------------------------------------------

bet=.95; // discount factor

gam=2; // CRRA parameter

del=.2; // depreciation rate

alpha=.33; // capital’s share

// Alignment convention:

// g tauc tauk are now columns of ex_. Because of a bad design decision the date of ex_(1,

// doesn’t necessarily match the date in endogenous variables. Whether they match depends on

// the number of lag periods in endogenous versus exogenous variables.

// These decisions and the timing conventions mean that

// k(1) records the initial steady state, while k(102) records the terminal steady state values.

// For j > 1, k(j) records the variables for j-1th simulation where the capital stock decision

// taken in j-1th simulation i.e stock at the beginning of period j.

// The variable ex_ also follows a different timing convention i.e

// ex_(j, records the value of exogenous variables in the jth simulation.

records the value of exogenous variables in the jth simulation.

// The jump in the government policy is reflected in ex_(11,1) for instance.

%-----------------------------------------------------------------------------------------------

% 3. Model

%-----------------------------------------------------------------------------------------------

model;

// equation 11.11.2

A=1*(1+mu)^(@{simulation_periods}+1);

// equation 11.11.4

k=(A*k(-1)^alpha+(1-del)*k(-1)-c-g)/mu;

// equation 11.11.6

c^(-gam)= bet*(c(+1)^(-gam)mu^(-gam))((1+tauc)/(1+tauc(+1)))((1-del) + (1-tauk(+1))alphaAk^(alpha-1));

end;

%-----------------------------------------------------------------------------------------------

% 4. Computation

%-----------------------------------------------------------------------------------------------

initval;

k=1.5;

c=0.6;

g = .2;

tauc = 0;

tauk = 0;

mu=0.02;

A=1*(1+mu)^0;

end;

// put this in if you want to start from the initial steady state,comment it out to start

// from the indicated values

// The following values determine the new steady state after the shocks.

endval;

k=1.5;

c=0.6;

g =.4;

tauc =0;

tauk =0;

mu=0.025;

A=1*(1+mu)^(@{simulation_periods}+1);

end;

// We use ‘steady’ again and the endval provided are initial guesses for dynare to compute the ss.

// The following lines produce a g sequence with a once and for all jump in g

// we use ‘shocks’ to undo that for the first 10 periods (t=0 until t=9)and leave g at

// it’s initial value of 0

// Note : period j refers to the value in the jth simulation

shocks;

var mu;

periods 1:10;

values 0.02;

end;

// now solve the model

simul(periods=100);

// Compute the initial steady state for consumption to later do the plots.

c0=c(1);

k0 = k(1);

// g is in ex_(:,1) since it is stored in alphabetical order

g0 = ex0_(3)

A0=1;

%-----------------------------------------------------------------------------------------------

% 5. Graphs and plots for other endogenous variables

%-----------------------------------------------------------------------------------------------

// Let N be the periods to plot

N=40;

// The following equation compute the other endogenous variables use in the plots below

// Since they are function of capital and consumption, so we can compute them from the solved

// model above.

// These equations were taken from page 371 of RMT3

rbig0=1/bet;

rbig=c(2:101).^(-gam)./(betc(3:102).^(-gam));

nq0=alphaA0k0^(alpha-1);

nq=alphaA(1:100).k(1:100).^(alpha-1);

wq0=A0k0^alpha-k0alphaA0*k0^(alpha-1);

wq=A(1:100).*k(1:100).^alpha-k(1:100).*alpha.*A(1:100).*k(1:100).^(alpha-1);

// Now we plot the responses of the endogenous variables to the shock.

x=0:N-1;

figure(1)

// subplot for capital ‘k’

subplot(2,3,1)

plot(x,[k0*ones(N,1)],’–k’, x,k(1:N),‘k’,‘LineWidth’,1.5)

// note the timing: we lag capital to correct for syntax

title(‘k’,‘Fontsize’,12)

set(gca,‘Fontsize’,12)

// subplot for consumption ‘c’

subplot(2,3,2)

plot(x,[c0*ones(N,1)],’–k’, x,c(2:N+1),‘k’,‘LineWidth’,1.5)

title(‘c’,‘Fontsize’,12)

set(gca,‘Fontsize’,12)

// subplot for cost of capital ‘R_bar’

subplot(2,3,3)

plot(x,[rbig0*ones(N,1)],’–k’, x,rbig(1:N),‘k’,‘LineWidth’,1.5)

title(’\overline{R}’,‘interpreter’, ‘latex’,‘Fontsize’,12)

set(gca,‘Fontsize’,12)

// subplot for rental rate ‘eta’

subplot(2,3,4)

plot(x,[nq0*ones(N,1)],’–k’, x,nq(1:N),‘k’,‘LineWidth’,1.5)

title(’\eta’,‘Fontsize’,12)

set(gca,‘Fontsize’,12)

// subplot for the experiment proposed

subplot(2,3,5)

plot([0:9],1 + oo_.exo_simul(1:10,4),‘k’,‘LineWidth’,1.5);

hold on;

plot([10:N-1],1 + oo_.exo_simul(11:N,4),‘k’,‘LineWidth’,1.5);

hold on;

plot(x,[g0*ones(N,1)],’–k’,‘LineWidth’,1.5)

title(‘mu’,‘Fontsize’,12)

axis([0 N -.1 .5])

set(gca,‘Fontsize’,12)

print -depsc fig_g.eps