Dear all,

I have two questions regarding the intuition behind DSGE-VARS and how they are implemented in dynare.

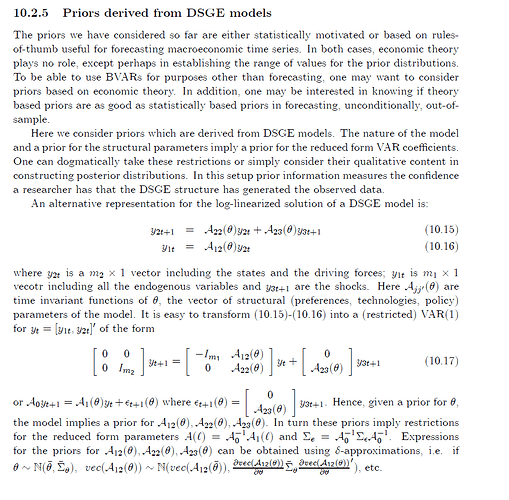

I understand that basically DSGE-VARs are a form of a Bayesian VAR in which the prior uses information from economic theory e.g. a DSGE model.

Based on https://git.dynare.org/Dynare/dynare/-/wikis/DSGE-VAR-model, if I understand correctly, the implementation in dynare uses the Dummy observations prior, and it uses artificial data from the DSGE model to augment the actual data and construct a prior for the Bayesian VAR. The relative weight of the artificial data, relative to the actual data, is then pinned down by the dsge_prior_weight.

My first question is : how does that imply identification? Because dynare spits out IRFs of the VAR that seem to be structural IRFs, e.g. responses to technology shocks or whatever is in the DSGE model. Based on Canovas Textbook, it looks as if the DSGE-VAR is identified via contemporaneous restrictions?

My second question : I noticed that when I change the dsge_prior_weight, say from dsge_prior_weight=1 to dsge_prior_weight=2, all the parameter estimates of the DSGE will change as a result. Initially, I thought the DSGE model parameter vector theta is still estimated just using the actual data, and whether and to what extent I estimate a DSGEVAR does not affect the DSGE estimates. But now, I guess what actually happens is: once I activate the option ‘dsge_var’ in dynare’s estimation command, I am no longer estimating the DSGE, but the DSGEVAR, which are two distinct things. I still find it a bit counterintuitive that the DSGE parameter estimates change with the dsge_prior_weight… does anyone have a good intuition for it?

Thanks a lot and kind regards