Dear all,

I built a DSGE model. The estimates are as follows

‘kappa_r 0.500 0.4083 0.3267 0.5599 gamm 0.1000

kappa_y 0.250 0.7562 0.6826 0.8270 beta 0.1000

kappa_pi 1.500 1.2397 1.1150 1.3563 gamm 0.1000’

kappa_y of estimated value looks a little big. What can we do to make kappa_y 's estimate less ?

For example, make kappa_y close to 0.2

That is impossible to tell without knowing a lot more details of the model. You need to understand economically why the data prefer such a large value. Here, we don’t even know what kappa_y represents. Mechanically, you could simply make the prior tighter, but that is not a good idea without knowing what the problem is.

jpfeifer, I’m sorry I didn’t explain my problem. ‘kappa_r ’ stand for interest coefficient of Monetary Policy; ‘kappa_y’ stand for output gap coefficient of monetary policy, ‘kappa_pi’ stand for Inflation coefficient of Monetary Policy.

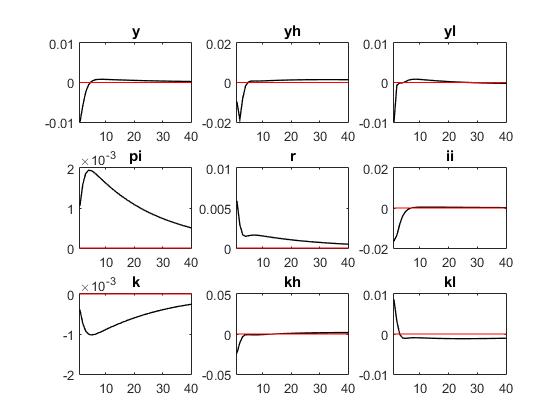

When I do Bayesian estimation,the other results seem to be correct, except for inflation. As picture followed.

I find when the value of kappa_y 's estimated is large, it’s going to have this problem. When the value of kappa_y 's estimated is small, there will be no such problem.

Why does inflation grow after monetary policy shocks? is it possible to tighten monetary policy to raise inflation?

data2018.xls (31 KB)

price.mod (10.7 KB)

jpfeifer, I follow US_CD08 in MMB completely. I really don’t understand why this problem arises. Is it possible that the model of this article (Christensen and Dib(2008) is problematic?

Please search the forum. This model has been discussed over and over again and AFAIK nobody ever got exactly the same results as the paper.

jpfeifer, thank you. I’m finally know it may be not my problem.