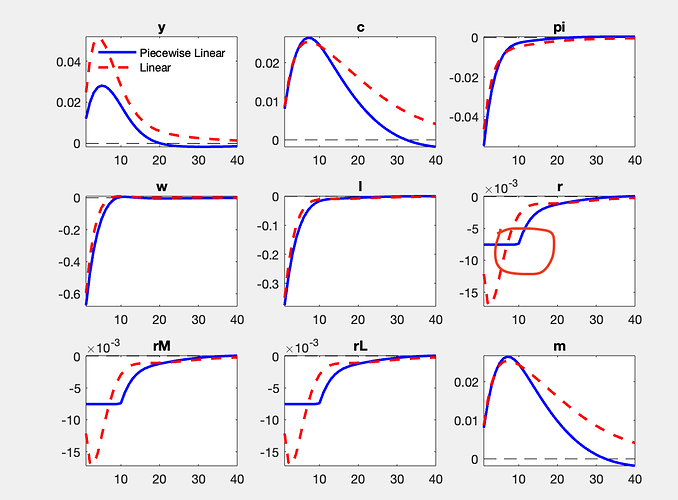

Dear professor, I use Occbin in Dynare 5.2 to simulate the effect of ZLB, then I get this picture.

I’m confused about the IFRs of variable r. It means that if a shock drag the rate into ZLB then rate will keep, for example at least 10 periods, in zero. But if rate does not constraint by ZLB, and dips into negative region , 7 periods after, it will raise above zero. In other words, two simulation paths have different periods is appropriate?

This is my code,

baseline_model.mod (5.0 KB)