Dear Professors

Dynare tell me I have problem in log-linearization

I want to see which of my equation and where it have problem, how can I do that?

Please upload your file, otherwise it is difficult for us to help you.

Dear Dr.

this is my cods:

var

//********* household variables****//

c (long_name='consumption')

n (long_name='hours worked')

w (long_name='real wage')

m (long_name='liquidity, m2 in household basket')

mcm (long_name='money, fisical money in the basket of household')

id (long_name='intrest rate of time and saving deposits')

d (long_name='time and saving deposits and demand deposits')

er (long_name='real exchang rate')

k (long_name='capital')

ii (long_name='intrest rate of government bonds and policy instroment')

pi (long_name='inflation')

pif (long_name='foreign inflation')

rk (long_name='intrest of investment')

inv (long_name='investment')

//********* firm variables****//

y (long_name='Total output')

a

L (long_name='Loan of intermediate firm from bank')

rl (long_name='the rate Loan of intermediate firm from bank')

mc (long_name='marginal cost of intermediate firm')

//********* bank variables****//

delthab (long_name='default rate')

icb (long_name='the rate of loan of bank from central bank')

Lcb (long_name='the loan of bank from central bank')

rr (long_name='legal deposit rate')

url (long_name='the deffrence rate of debt to firm and deposit rate')

//********* open economy sector****//

or (long_name='oil revenue')

//********* government and central bank sector****//

g (long_name='government expenditure')

mui (long_name='money growth rate')

dc (long_name='Seigniorage')

fr (long_name='foreign assets of central bank')

mb (long_name='monetary base')

//********* shocks variables**********************//

shi_m (long_name='money demand shocks')

deltha_en (long_name='nominal exchang rate growth shocks')

shi_i;

//----------------------Exogenous variables------------------------------------//

varexo

u_a u_m u_or u_g u_rr shi_url shi_pif shi_dc u_shi_i u_deltha_en;

//----------------------Parameters---------------------------------------------//

Parameters

betta

etta

delthab_b

url_b

rr_b

pi_b

pc_b

deltha

alphha

phi_ns

tetta

ltvf

n_b

g_b

be

ve

a_b

dc_mb

omegha

rho_m

rho_url

rho_a

rho_delthab

phi_delthay

rho_or

rho_g

rho_deltha_en

rho_pif

rho_dc

rho_i

rho_pi

rho_y

rho_mui

rhoshi_i

rho_rr

id_b

d_mcm

m_mcm

icb_b

rl_b

rk_b

mc_b

k_b

inv_b

w_b

c_b

m_b

y_b

mcm_b

d_b

mb_b

L_b

Lcb_b

er_bfr_b

fr_b

;

//-------------------Parametrization---------------------------------//

betta=0.965;

etta=0.0486807597119462;

delthab_b=0.008;

url_b=0.009;

rr_b=0.1;

pi_b=1.042246635;

pc_b=1.0154321;

deltha=0.055;

alphha=0.588;

phi_ns=2;

tetta=7;

ltvf=0.9;

n_b=1;

g_b=1;

be=0.05;

ve=1.3153;

a_b=1;

dc_mb=0.13;

omegha=0.351;

rho_m=0.8;

rho_url=0.8;

rho_a=0.9;

rho_delthab=0.8;

phi_delthay=0.8;

rho_or=0.779;

rho_g=0.875;

rho_deltha_en=0.8;

rho_pif=0.8;

rho_dc=0.8;

rho_i=0.5;

rho_pi=0.9;

rho_y=0.02;

rho_mui=0.8;

rhoshi_i=0.8;

rho_rr=0.8;

id_b=((((1-rr_b-delthab_b+(rr_b*delthab_b))*url_b)/(rr_b+delthab_b-(rr_b*delthab_b)))+1)^(1/4);

d_mcm=(1-(betta/pi_b))/(1-((betta/pi_b)*id_b))*((1-etta)/etta);

m_mcm=(d_mcm)^(1-etta);

icb_b=id_b/(1-rr_b);

rl_b=id_b+url_b;

rk_b=(1/betta)-1+deltha;

mc_b=(tetta-1)/tetta;

k_b=(alphha*mc_b*rk_b/(1+(ltvf*rl_b)))^(1/(1-alphha));

inv_b=k_b*deltha;

w_b=((1-alphha)/alphha)*rk_b*k_b;

c_b=((1-be)*w_b)^(1/ve);

m_b=(((1-be)*(1-(betta*id_b/pi_b))/(be*etta*(d_mcm^((-1)*etta))))^(-1/ve))*c_b;

y_b=k_b^alphha;

mcm_b=m_b/((d_mcm)^(1-etta));

d_b=mcm_b*d_mcm;

mb_b=mcm_b+(d_b*rr_b);

L_b=ltvf*((w_b*n_b)+(rk_b*k_b));

Lcb_b=(0.3333*mb_b);

er_bfr_b=(0.3333*mb_b);

fr_b=(0.3333*mb_b);

//----------------------Model Declaration Block--------------------------------//

model(linear);

m=etta*mcm+(1-etta)*d;

//labor supply//

phi_ns*n=w-(ve*c);

// fisical money demand//

((be*etta*(m_b^(-ve))*((d_mcm)^(1-etta)))*((-ve)*m+(etta-1)*mcm+(1-etta)*d+shi_m))+(betta/pi_b)*(1-be)*(c_b^(-ve))*((-ve*c(+1))-pi(+1))=(1-be)*(c_b^(-ve))*(-ve*c);

// deposit demand//

((be*(1-etta)*(m_b^(-ve))*((d_mcm)^(-etta)))*((-ve)*m+(etta)*mcm+(-etta)*d+shi_m))+(betta/pi_b)*(1-be)*(c_b^(-ve))*(id_b)*(((-ve*c(+1))-pi(+1))+id)=(1-be)*(c_b^(-ve))*(-ve*c);

//money demand shock//

shi_m=rho_m*shi_m(-1)+u_m;

//investment//

inv = (1/deltha)*(k-(1-deltha)*k(-1));

//Euler//

c=c(+1)-(1/ve)*(ii-pi(+1));

//prodution function//

y=alphha*k(-1)+(1-alphha)*n;

//factor demand//

w=k(-1)+rk-n;

//marginal cost//

mc=(((1/alphha)^(alphha))*((1/(1-alphha))^(1-alphha))*(rk_b^alphha)*(w_b^(1-alphha))/mc_b)*((1+(ltvf*rl_b))*((alphha*rk)+((1-alphha)*w)-a)+(ltvf*rl_b*rl));

//Loan of firm from bank//

L=(ltvf/L_b)*(((w_b*n_b)*(w+n))+((rk_b*k_b)*(rk+k)));

//the intrest rate of central bank to comercial one//

icb=(rl_b/icb_b)*(1-delthab_b)*rl-(rl_b*delthab_b/icb_b)*delthab;

//deposit intrest rate//

id=(1-rr_b)*(icb_b/id_b)*icb-(icb_b*rr_b/id_b)*rr;

rr=rho_rr*rr(-1)+u_rr;

//debt or firms to bank//

L=(d_b/L_b)*(1-rr_b)*d-(d_b*rr_b/L_b)*rr+(Lcb_b/L_b)*Lcb;

//the rate of debt to firm//

rl=((id_b/rl_b)*id)+url;

//the deffrence rate of debt to firm and deposit rate//

url=rho_url*url(-1)+shi_url;

//technology shoch//

a=rho_a*a(-1)+u_a;

//phillps curve//

pi=betta*pi(+1)+((1-omegha*betta)*(1- omegha)/ omegha)*mc;

//default rate//

delthab=rho_delthab*delthab(-1)+phi_delthay*y;

//oil export//

or=rho_or*or(-1)+u_or;

//government expenditure shock//

g=rho_g*g(-1)+u_g;

//monatary base According to sources//

mb=(dc_mb)*dc+(Lcb_b/mb_b)*Lcb+(er_bfr_b/mb_b)*(er+fr);

//monatary base According to expenses//

mb=(mcm_b/mb_b)*mcm+(rr_b*d_b/mb_b)*(rr+d);

//real exchange rate//

er=er(-1)+deltha_en+pif-pi;

deltha_en=rho_deltha_en*deltha_en(-1)+u_deltha_en;

//money growth rate//

mui=m-m(-1)+pi;

//foreign reserves of the central bank//

fr=fr(-1)-pif+(1/fr_b)*or;

//foreign inflation//

pif=rho_pif*pif(-1)+shi_pif;

//Deficit//

dc=rho_dc*dc(-1)+shi_dc;

//intrest rate target (monatary policy target)//

ii=rho_i*ii(-1)+rho_pi*(pi-pc_b)+rho_y*(y)+rho_mui*(mui)+shi_i;

shi_i=rhoshi_i*shi_i(-1)+u_shi_i;

//resource constraint//

y=(c_b/y_b)*c+(inv_b/y_b)*inv+(g_b/y_b)*g;

end;

//----------------------Initial Value of Endogenous Variables Block -----------//

initval;

c=0;

n=0;

w=0;

m=0;

mcm=0;

id=0;

d=0;

er=0;

k=0;

ii=0;

pi=0;

pif=0;

rk=0;

inv=0;

//********* firm variables****//

y=0;

a=0;

L=0;

rl=0;

mc=0;

//********* bank variables****//

delthab=0;

icb=0;

Lcb=0;

rr=0;

url=0;

//********* open economy sector****//

or=0;

//********* government and central bank sector****//

g=0;

mui=0;

dc=0;

fr=0;

mb=0;

//********* shocks variables**********************//

shi_m=0;

deltha_en=0;

shi_i=0;

end;

steady;

check;

//----------------------The Shocks Block---------------------------------------//

shocks;

var u_a;

stderr 0.01;

var u_m;

stderr 0.01;

var u_or;

stderr 0.01;

var u_g;

stderr 0.01;

var u_rr;

stderr 0.01;

var shi_url;

stderr 0.01;

var shi_pif;

stderr 0.01;

var shi_dc;

stderr 0.01;

var u_shi_i;

stderr 0.01;

var u_deltha_en;

stderr 0.01;

end;

//----------------------The Simulation Block-----------------------------------//

stoch_simul(periods=10000, irf=30);

I dont know if this error comes from the way you copy your file in here ( I would suggest just uploading the mod file and not copy pasting the code in here) but for me there are many things not working in the way you setup the parameters. Could you please upload the file?

I did not find up load option it this site, how can I send you my file?

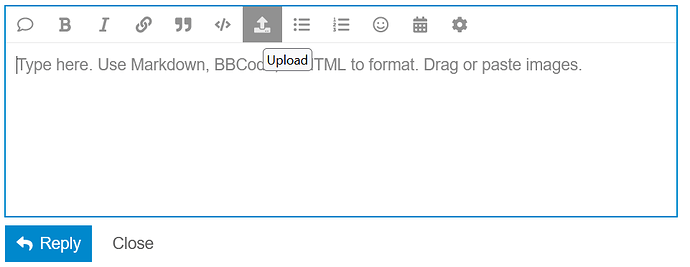

@zeynooo, This is how.

There was a wrong constant in the third-last equation that I deleted:

zeynooo.mod (7.7 KB)

Now your model features instability. You need to find out why.

Dear Professor

I really appreciate you.

Dear Pr. How can I realize such problem myself?