Hi everyone,

I understand that the price level in standard NK models is typically indeterminate, and only its growth rate (i.e., the inflation rate) is determined.

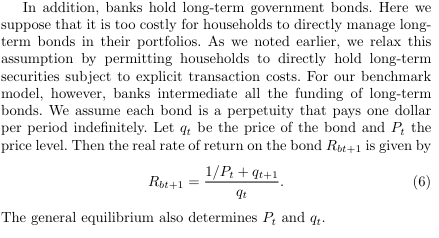

My question concerns the model in Gertler/Karadi 2013 (pdf here: https://www.ijcb.org/journal/ijcb13q0a1.pdf) and the determinacy of the price level in that model. In the model, the real rate of return Rb on a government bond seems to implicitly define the price level P as a function of the real bond price q (see screenshot below). The nominal side of the model features standard pricing frictions and a Taylor rule.

Now, when solving for steady state, I can obtain values for steady-state Rb and steady-state q (from other model equations). Does this imply that the bond return in equation (6) pins down the steady-state price level? Am I right in concluding that the price level is determinate in GK13?

Thanks for any help!