Dear professor jpfeifer,

May I ask you a question on open economy DSGE model,

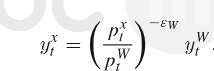

Foreign demand for the home country’s exported goods is inversely related to the relative price of export goods and positively related to aggregate demand in the foreign country. so exports are always define as:

My question is on what exactly y_w mean?

In Adolfson et al. (2007), they denote y_w as the world output(GDP), but in steady-state, relative price is 1 and export demand elasticity is etimated to about only 1.3. so I think the steady-state value of world output simply equals the exports, but this does not make sense as we know world output should be much bigger than exports of home country.(Bayesian Estimation of an Open Economy DSGE Model with

Incomplete Pass-Through)

In Burriel et.al. (2011) , they denote y_w as the world demand and export demand elasticity is etimated to about 9.

In Chang et.al. (2015), they denote y_w as the aggregate demand in the foreign country while export demand elasticity is calibrated to 1.5, which is small.

So what is exactly y_w mean and the value of export demand elasticity should be small or big?

I think if y_w is world output, then export demand elasticity should be quite big, and the value of export demand elasticity should also be big.

If y_w is the world demand, then demand for what? for home country’s exported goods?

One small question: can investment be negative numbers?

Thank you, professor, waiting for your helps, always thank you.