Hello Friends,

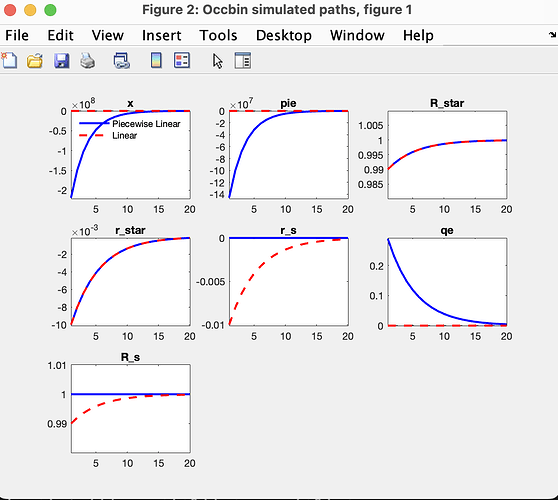

Im trying to replicate Chapter 3.2 of Sims (2023) four equation new-keynesian model.

Here a ZLB binds in expectation 4 periods due to an adverse natural rate shock.

I have so far replicated most findings of the paper, my reference model is thus operational.

I do, however run into issues with my ZLB config. I get the following error of: "Operation terminated by user during occbin.mkdatap_anticipated_dyn (line 100)

In occbin.solve_one_constraint (line 190)

[zdatalinear_, SS_out.T(:,:,shock_period), SS_out.R(:,:,shock_period), SS_out.C(:,shock_period), SS, update_flag]=occbin.mkdatap_anticipated_dyn(nperiods_0,DM,…

In occbin.solver (line 84)

[out, ss, error_flag ] = occbin.solve_one_constraint(M_,dr,options_.occbin.simul,solve_dr);

In OptimalPolicyZLB.driver (line 475)

[oo_.dr, oo_.occbin.simul]= occbin.solver(M_, options_, oo_.dr , oo_.steady_state, oo_.exo_steady_state, oo_.exo_det_steady_state);

In dynare (line 310)

evalin(‘base’,[fname ‘.driver’]);"

I suspect, that I can’t use the linearised model for this or need to account for the nominal gross interest rate sticking to 1. Otherwise, maybe, I need to give ss - values for the model, which I have not since I encoded the model block as linear.

I would rly appreciate any help, thank you !

OptimalPolicyZLB.mod (8.3 KB)