Hello everyone, I am now learning to use Occbin to solve ZLB problem.

I added the ZLB condition on the basis of Eskelinen(2021), the model was linearized, and the nominal interest rate was used in the other equations but Taylor rule according to https://forum.dynare.org/t/irfs-issues-in-sw07-with-zlb/22080.

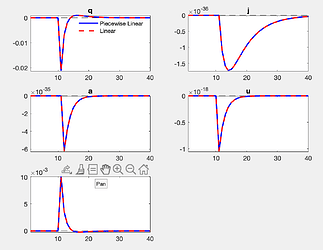

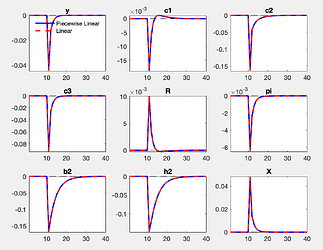

However, the IRFs I got was still very anomalous and didn’t reflect the constraints.

How should I solve it?

Eskelinen2021.mod (2.8 KB)

Eskelinen 2021 Agent heterogeneity and inequality.pdf (1.5 MB)