Dear Professor,

I hope you are well. I have been trying to solve a simple model using Occbin, and generate the IRFs under both ZLB and non-ZLB. To do so, I followed the structure of your NK example in github. I have attached my code for reference.

However, I encountered an issue:

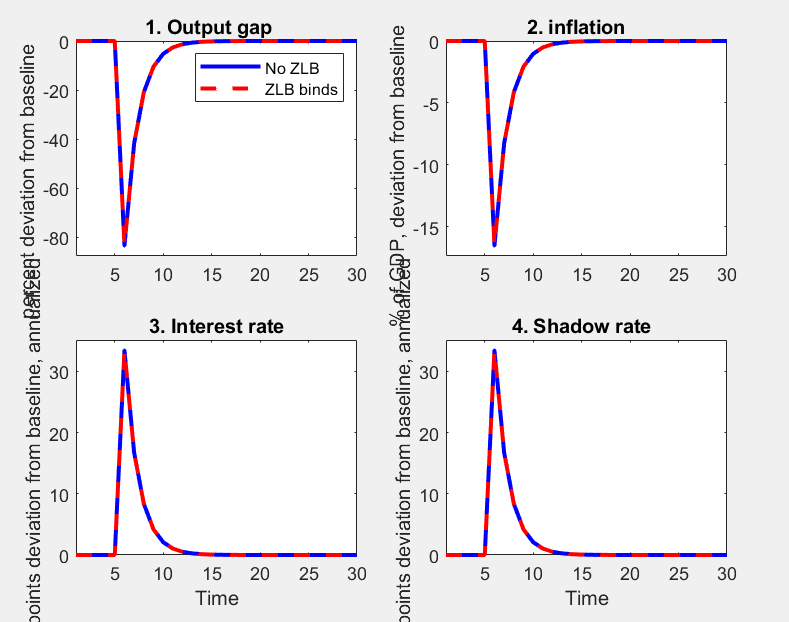

the IRFs under the ZLB and non-ZLB cases are virtually identical, even when I adjust the ZLB constraint specifications (e.g., changing the threshold or modifying the constraint formulation). I am not sure why this happens, and I would be very grateful for any guidance on possible reasons or how I might resolve this.

runsim_dnk.m (3.9 KB)

dnk_zlb.mod (135 Bytes)

DNK_model_common.inc (507 Bytes)

dnk.mod (737 Bytes)

Additionally, I noticed that some codes in Occbin use

occbin_setup; and occbin_solver;

while the NK example in github use different routines. I would like to ask whether these formats are functionally equivalent, or whether there are important differences in how the solver handles regimes.

Any advice or clarification you could offer would be extremely helpful.

Thank you very much for your time.

Dear Professor,

Thank you very much for your guidance, and I sincerely apologise for not explaining my code clearly in my previous message.

I am following the code you shared on GitHub (link: Occbin_update/model_dnk at master · JohannesPfeifer/Occbin_update · GitHub ).

You used A simple New-Keynesian model with government spending, and I want to simplify it into a more basic three-equation New Keynesian model. Based on your code on GitHub, I set up the ZLB in the model using OccBin (I shared the codes in my previous message). Then I introduced a large negative preference shock to push the economy into the ZLB and compared the IRFs of a positive monetary policy shock under both ZLB and non-ZLB regimes.

However, the IRFs of a positive monetary policy shock I obtained—shown in my earlier figure—are identical across the ZLB and non-ZLB simulations. This confused me, because the responses should differ once the constraint binds. I am wondering whether I may have mis-specified the ZLB constraint in OccBin, and I would be extremely grateful if you could offer any suggestions on how to diagnose or correct this issue.

In addition, I noticed that some implementations of OccBin use the commands occbin_setup and occbin_solver, while the NK example on your GitHub uses a different routine. Could I ask whether these approaches are equivalent? And which version you would recommend if my goal is first to construct a ZLB environment and then analyse shocks within that constrained environment?

Thank you very much for your time and guidance. I truly appreciate your help.

The file you link to is the file for the original OccBin toolkit. It is not a file compatible with the OccBin implementation that Dynare ships. There occbin_setup and occbin_solver are mandatory.

Thank you so much for your reply, Professor. I’ll switch to Dynare’s implementation and use occbin_setup and occbin_solver instead. Many thanks again!