Dear Community,

I developed a model to check the impact of fiscal deficits and current account deficit on inflation. My model has 2 AR1 shock process: one for fiscal deficit and the other for current account deficit.

d = (1 - rho_d) * d_bar + rho_d * d(-1) + e_d;

yF = (1 - rho_yF) * yF_bar + rho_yF * yF(-1) + e_yF;

Where d and yF are the fiscal and current account deficit respectively as a percentage of GDP.

I read the “A Guide to Specifying Observation Equations for the Estimation of DSGE Models” by Johannes Pfeifer and I have encountered with 2 questions:

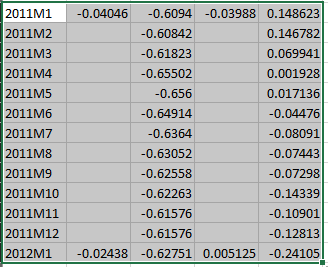

1- My model is at a monthly level, I have all my parameters and other observables at this frequency. The problem here is that fiscal and current account deficit data are yearly so what I did is to follow section 7.3 of the above mentioned guide and prepare the excel file accordingly, here is an extract of input data:

My question will be on how to map this to the model: What I understand from other questions from this forum is that deficit is a stock variable and output is a flow variable, so the data point is actually the level of deficit at that month, would this mean that the mapping of observable variable to the variable model is just:

d = d_obs;

2- My second question is related to: one, my shocks are AR1, so they are already linear, and two, because I am working with deficits, my data has negative numbers so I can’t log-linearized variables d and yF. So, how should I deal with the observation data? should I demean it around the steady state? or don’t do any transformations?

I did the first approach but I am not 100% sure if this is okay. Any advice will be such a help!

Thanks in advance!

Gustavo Pinto