okok ,thank you very much ~

Hello Professor @jpfeifer , I’m also new user of DSGE model and then I would like to ask you about the meaning of full information extimation ? Does it mean estimation of a DSGE model where one disposes data for all variables ?..I’m sorry if my question is so basic but I’m a little bit confused

That is the typical term used to refer to likelihood-based estimation techniques. The likelihood incorporates all information, i.e. is a sufficient statistic.

Dear,@jpfeifer ,

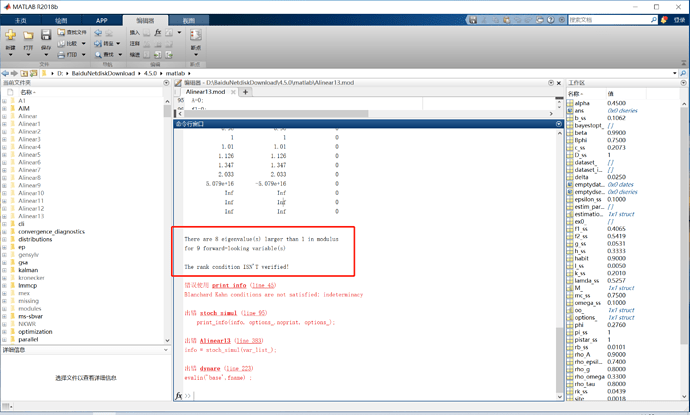

My DSGE model always reports errors, as shown in the figure below, and the code is in the attachment.

The paper is about to be submitted  . The program has been running wrong. I’m very anxious.I hope you can help me find what’s wrong.Thank you very much teacher.

. The program has been running wrong. I’m very anxious.I hope you can help me find what’s wrong.Thank you very much teacher.

code.txt (2.8 KB)

There is indeterminacy in your model. You should try to simplify the model. How is inflation determined? I don’t see a Taylor rule.

@jpfeifer In the model, I did not introduce monetary policy rules, but only fiscal policy rules.

The equation for inflation is:1=(1-Bphi)pistar^(1-theta)+Bphipi^(theta-1),

Its logarithmic linearization is :(1-Bphi)*(1-theta)pistar+Bphi(theta-1)*pi=0 【In the code I just sent you】

So this is a case of the fiscal theory of the price level?

Yes, what is the reason why the model keeps reporting errors

Have you tried to first solve the model with the standard active monetary, passive fiscal policy before inverting the roles?

Thank you for your answer. I’ll think about it again

Hello Prof @jpfeifer, I would like to ask another question about the “number of observed variables and exogenous shocks in the DSGE model”. In the case of the Bayesian simulation technique where prior information are used, should we consider that rule of “number of observed variables must be equaled to exogenous shocks” or not ?. Thank you in advance

Nobody ever said the number must be equal. You need at least as many shocks as observables.

@jpfeifer Hello, professor

In the DSGE model, does K in the family budget equation mean the same as dividend interest?

Personal income tax will be levied on wages, salaries and dividend interest. Personal income tax is introduced into the family budget constraint of DSGE model. Whether it can be set like this (as shown in the figure) means that personal income tax is levied on wages, salaries and capital income.

The red mark in the picture indicates the individual income tax rate

I am not sure I understand where the question is going. The return to capital in such models usually is more than just dividends. Because the capital structure is not explicitly modeled, it refers to both dividend and bond income from firms.

OK, thank you, professor~

Professor, does the capital in DSGE model include plant, equipment and machinery?

Usually, it does.

thank you, professor