this is the text:

%define whether to use interest rate or money growth rate rule

@#define money_growth_rule=0

var pi1 {\pi} (long_name=‘inflation’)

y_gap {\tilde y} (long_name=‘output gap’)

y_nat {y^{nat}} (long_name=‘natural output’) //(in contrast to the textbook defined in deviation from steady state)

y {y} (long_name=‘output’)

g {g} (long_name=‘output_growth’)

r_nat {r^{nat}} (long_name=‘natural interest rate’)

r_real {r^r} (long_name=‘//real interest rate’)

i1 {i} (long_name=‘nominal interrst rate’)

n {n} (long_name=‘hours worked’)

m_real {m-p} (long_name=‘real money stock’)

m_growth_ann {\Delta m} (long_name=‘money growth annualized’)

@#if money_growth_rule==0

nu {\nu} (long_name=‘AR(1) monetary policy shock process’)

@#else

money_growth {\Delta m_q} (long_name=‘money growth’)

@#endif

a {a} (long_name=‘AR(1) technology shock process’)

r_real_ann {r^{r,ann}} (long_name=‘annualized real interest rate’)

i_ann {i^{ann}} (long_name=‘annualized nominal interest rate’)

r_nat_ann {r^{nat,ann}} (long_name=‘annualized natural interest rate’)

pi_ann {\pi^{ann}} (long_name=‘annualized inflation rate’)

z

;

varexo eps_a {\varepsilon_a} (long_name=‘technology shock’)

@#if money_growth_rule==0

eps_nu {\varepsilon_\nu} (long_name=‘monetary policy shock’)

@#else

eps_m {\varepsilon_\m} (long_name=‘money growth rate shock’)

@#endif

eps_z {\varepsilon_\z} (long_name=‘money growth rate shock’)

;

parameters alppha {\alppha} (long_name=‘capital share’)

betta {\beta} (long_name=‘discount factor’)

rho_a {\rho_a} (long_name=‘autocorrelation technology shock’)

@#if money_growth_rule==0

rho_nu {\rho_{\nu}} (long_name=‘autocorrelation monetary policy shock’)

@#else

rho_m {\rho_{m}} (long_name=‘autocorrelation monetary growth rate shock’)

@#endif

siggma {\sigma} (long_name=‘log utility’)

phi {\phi} (long_name=‘unitary Frisch elasticity’)

phi_pi {\phi_{\pi}} (long_name=‘inflation feedback Taylor Rule’)

phi_y {\phi_{y}} (long_name=‘output feedback Taylor Rule’)

eta {\eta} (long_name=‘semi-elasticity of money demand’)

epsilon {\epsilon} (long_name=‘demand elasticity’)

theta {\theta} (long_name=‘Calvo parameter’)

;

%----------------------------------------------------------------

% Parametrization, p. 52

%----------------------------------------------------------------

siggma = 1;

phi=1;

phi_pi = 1.5;

phi_y = .5/4;

theta=2/3;

@#if money_growth_rule==0

rho_nu =0.5;

@#else

rho_m=0.5;

@#endif

rho_a = 0.9;

betta = 0.99;

eta =4;

alppha=1/3;

epsilon=6;

sig_z = 0.0109 ;

%----------------------------------------------------------------

% First Order Conditions

%----------------------------------------------------------------

model(linear);

//Composite parameters

#Omega=(1-alppha)/(1-alppha+alpphaepsilon); //defined on page 47

#psi_n_ya=(1+phi)/(siggma(1-alppha)+phi+alppha); //defined on page 48

#lambda=(1-theta)(1-bettatheta)/thetaOmega; //defined on page 47

#kappa=lambda(siggma+(phi+alppha)/(1-alppha)); //defined on page 49

//1. New Keynesian Phillips Curve eq. (21)

pi1=bettapi1(+1)+kappay_gap;

//2. Dynamic IS Curve eq. (22)

y_gap=-1/siggma*(i1-pi1(+1)-r_nat)+y_gap(+1);

//3. Interest Rate Rule eq. (25)

@#if money_growth_rule==0

i1=phi_pipi1+phi_yy_gap+nu;

@#endif

//4. Definition natural rate of interest eq. (23)

r_nat=siggmapsi_n_ya(a(+1)-a);

//5. Definition real interest rate

r_real=i1-pi1(+1);

//6. Definition natural output, eq. (19)

y_nat=psi_n_yaa;

//7. Definition output gap

y_gap=y-y_nat;

//8. Monetary policy shock

@#if money_growth_rule==0

nu=rho_nunu(-1)+eps_nu;

@#endif

//9. TFP sh

a=rho_aa(-1)+eps_a;

//10. Production function (eq. 13)

y=a+(1-alppha)n;

//11. Money growth (derived from eq. (4))

m_growth_ann=4(y-y(-1)-eta(i1-i1(-1))+pi1);

//12. Real money demand (eq. 4)

m_real=y-etai1;

@#if money_growth_rule==1

//definition nominal money growth

money_growth=m_real-m_real(-1)+pi1;

//exogenous process for money growth

money_growth=rho_m(money_growth(-1))+eps_m;

@#endif

//13. Annualized nominal interest rate

i_ann=4i1;

//14. Annualized real interest rate

r_real_ann=4r_real;

//15. Annualized natural interest rate

r_nat_ann=4r_nat;

//16. Annualized inflation

pi_ann=4pi1;

g = y - y(-1) + z;

z = eps_z ;

end;

%----------------------------------------------------------------

% define shock variances

%---------------------------------------------------------------

shocks;

@#if money_growth_rule==0

var eps_nu = 0.25^2; //1 standard deviation shock of 25 basis points, i.e. 1 percentage point annualized

@#else

var eps_m = 0.25^2; //1 standard deviation shock of 25 basis points, i.e. 1 percentage point annualized

@#endif

var eps_a = 1^2; //unit shock to technology

var eps_z = sig_z^2 ;

end;

%----------------------------------------------------------------

% steady states: all 0 due to linear model

%---------------------------------------------------------------

resid;

steady;

check;

%----------------------------------------------------------------

% generate IRFs, replicates Figures 3.1, p. 53 (interest rate rule)

% 3.3, p. 57 (money growth rule)

%----------------------------------------------------------------

@#if money_growth_rule==0

stoch_simul(order = 1,irf=15) y pi1 i1 ;

@#else

stoch_simul(order = 1,irf=15) y pi1 i1 ;

@#endif

shocks;

@#if money_growth_rule==0

var eps_nu = 0; //shut off monetary policy shock

@#else

var eps_m = 0; //shut off monetary policy shock

@#endif

var eps_a = 1^2; //unit shock to technology

var eps_z = sig_z^2 ;

end;

%----------------------------------------------------------------

% generate IRFs, replicates Figures 3.2, p. 55 (interest rate rule)

% 3.4, p. 59 (money growth rule)

%----------------------------------------------------------------

stoch_simul(order = 1,irf=15,irf_plot_threshold=0) y pi1 i1 n a ;

write_latex_dynamic_model;

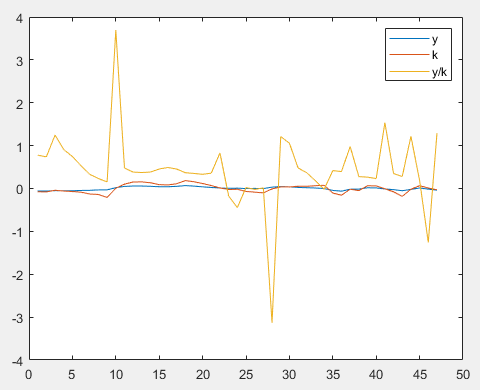

varobs y i1 pi1;

% Load the data file (assuming ‘data.mat’ as an example filename)

% Make sure ‘data.mat’ contains a MATLAB table named ‘data’

% Define the estimated parameters

estimated_params;

betta, beta_pdf, 0.99, 0.02;

stderr eps_nu, normal_pdf, 0.01, inf;

stderr eps_a,0.4618,0.01,3,INV_GAMMA_PDF,0.1,2;

stderr eps_z,0.6090,0.01,3,INV_GAMMA_PDF,0.1,2;

end;

% Perform the estimation

%estimation(datafile=data, mode_compute=0, mh_replic=2000,

%mh_nblocks=2, mh_drop=0.1, mh_jscale=2.5, conf_sig=0.95, bayesian_irf, irf=20);

estimation(optim=(‘MaxIter’,200),datafile=data,mode_compute=0,

first_obs=1, presample=4,lik_init=2,prefilter=0,mh_replic=0,mh_nblocks=2,

mh_jscale=0.20,mh_drop=0.2, conf_sig=0.95, bayesian_irf,

irf=0, nograph, nodiagnostic, tex);

shock_decomposition y;