Dear professors,

I am building up a two asymmetric two-country model with financial frictions and compare it to the base model of Benigno(2009). I observe the amplified effect on GDP, consumption and investment but the inflation dynamic is quite the same for some shocks. Does it imply anything wrong with my model or a mistake somewhere? Base on IRF, does it look weird? Thank you so much for any kind of help.

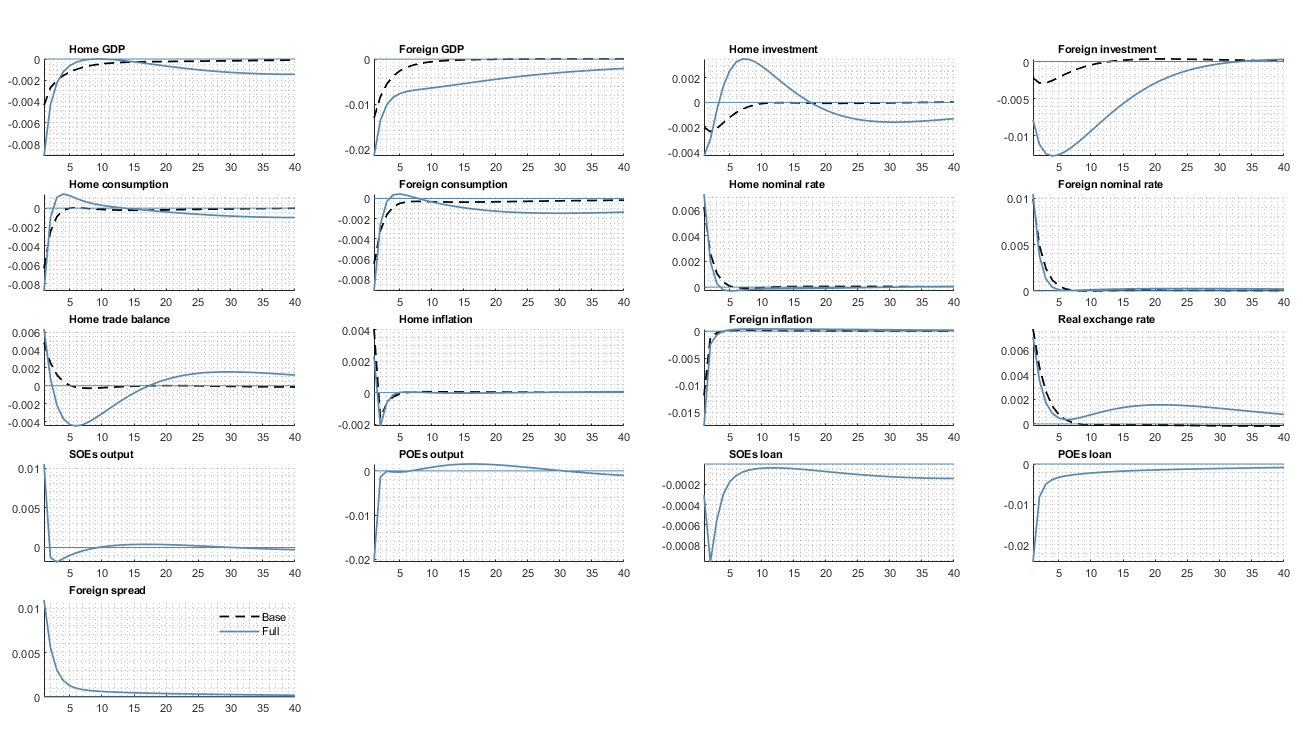

Foreign positive monetary shock

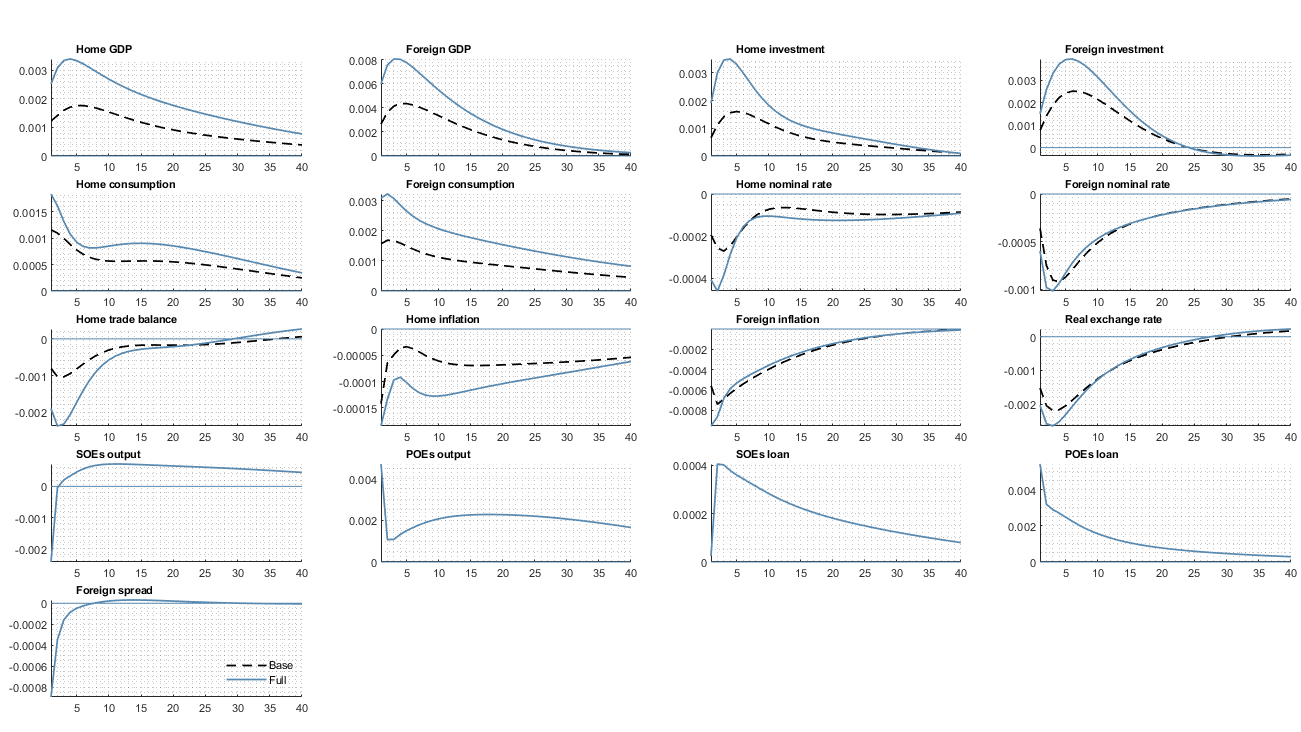

Foreign positive TFP shock

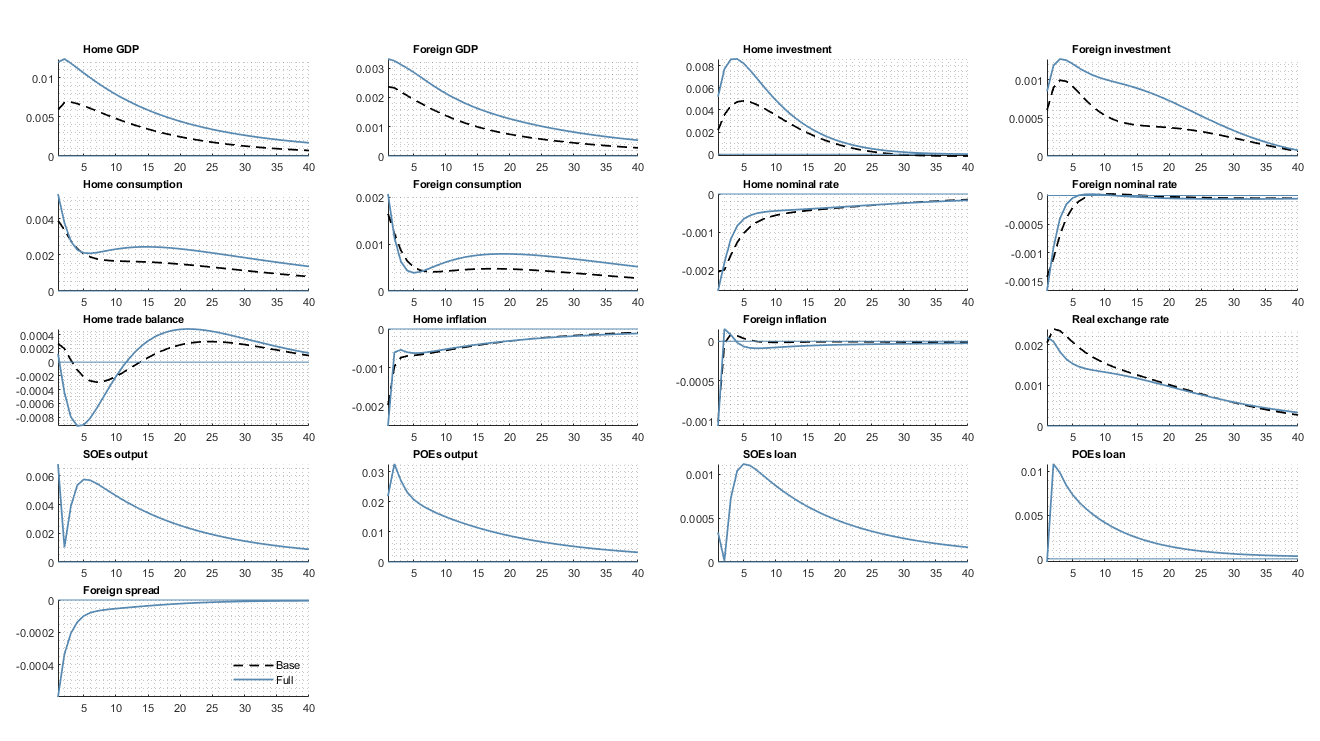

Home positive TFP shock

I doubt someone will be able to help you. It’s a very specific question for a special (and large) model that you built. That makes it impossible to get an intuition what is going on.

Thank you prof Pfeifer, can you suggest anything to start? any suggestion is really useful. I can post my mod file also if it helps.

A typical way to proceed is to vary parameters in order to get a better understanding of the way the model works. In your case, you seem to be saying that the slope of the Phillips curve changed quite strongly. You should try to understand why.

1 Like

Thank you so much for your suggestion. In addition, if I add financial frictions, should I also have to observe a huge differences in inflation compared to a base model without financial frictions?

There is no general answer to this. It depends on the model and the frictions. There are situations when the frictions mostly have real as opposed to nominal effects.

1 Like