Let me describe my questions thoroughly. The first confusion arises from the definition of gross nominal interest rate. In Gali(2015), the interest rate is defined as

i_t = \ln R_t = -\ln Q_t

and the interest rate rule is

e^{i_t}=\frac{1}{\beta}\left(\Pi_t\right)^{\varphi_\pi}\left(\frac{Y_t}{Y}\right)^{\varphi_y} e^{v_t}

The corresponding dynare codes are

i = log(R)

exp(i) = (1/beta)*(pi)^(phi_pi)*(Y/steadystate(Y))^(phi_pi)*e^(v_t)

If we focus on the percentage deviation from the steady state, the codes can be modified as

exp(i) = R

The confusion lies in the second equation, is it

exp(exp(i)) = (1/beta)*(exp(pi))^(phi_pi)*(exp(Y)/steadystate(exp(Y)))^(phi_pi)*e^(v_t)?

Back to GK, here the definition of gross nominal interest rate is

i_t=R_t\Pi_{t+1}

The interest rate rule is

i_t=(1-\rho)\left[1/\beta+\kappa_\pi \pi_t+\kappa_y\left(\log Y_t-\log Y_t^*\right)\right]+\rho i_{t-1}+\varepsilon_t

If we now focus on level deviation, then dynare codes are

i = R*pi(+1)

exp(i) = exp(i(-1))^rho_i*((1/beta)*exp(pi)^kappa_pi*(exp(X)/(epsilon/(epsilon-1)))^(kappa_y))^(1-rho_i)*exp(e_i);

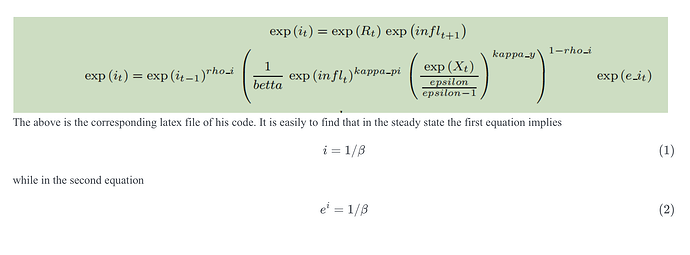

Now if we focus on percentage deviation, the fisher equation should be

exp(i) = exp(R)*exp(pi(+1))

What about interest rate? Why in his code FA.mod (7.4 KB), the interest rate is still

exp(i) = exp(i(-1))^rho_i*((1/beta)*exp(pi)^kappa_pi*(exp(X)/(epsilon/(epsilon-1)))^(kappa_y))^(1-rho_i)*exp(e_i);?