Dear all,

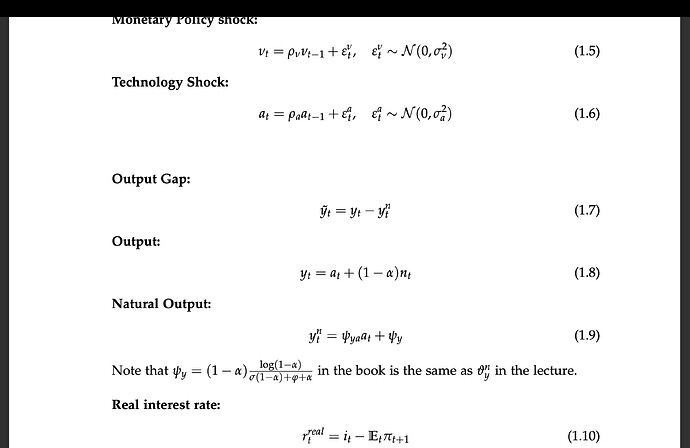

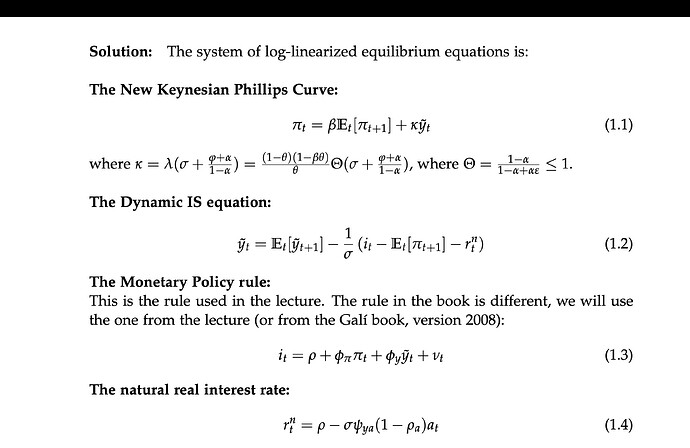

my question regards the functional form of my New Keynesian Model input, i.e., what Dynare does for certain inputs.

My experiences/understanding of it from my work with an RBC model so far is the following:

- if I give my model already log-linearized into dynare (thus “de-meaned” already with the mean beeing the steady-state value of the respective variables) then I will get my output in %-deviations due to the log-linearization.

- If I give it in the non-linear form Dynare will linearize it for me and I will get the output in absolute values.

- If I subtract the corresponding non-linear steady-state equation from the respective non-linear model equation I would get the absolute deviations.

Did I get something wrong?

But now, if I move to the standard New Keynesian Model (NKM) and I have my logged equations, I first need to subtract the respective steady-state equations, I guess that is because they are not (at least not all of them) really log-linearized / de-meaned the way they are given here and thus are not expressed as deviations from the steady state already, is that maybe the problem?

In order for you to know what model I am talking about exactly please find a picture attached.

Best regards