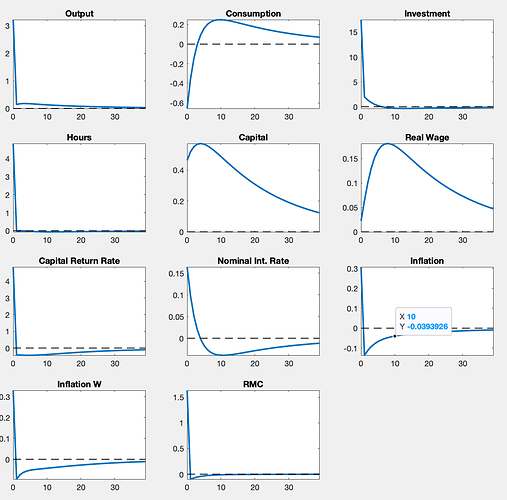

In the .mod file attached I observe the following Impulse Response functions

I can’t understand why the inflation is higher than nominal interest rate; given the Taylor rule it should be the opposite.

Also I cannot understand the real wage dynamics, the first value above zero and the rising curve.

I’ll provide everything else is needed to understand the problem.

Thanks for all the aid provided here!

esercizio2.mod (4.6 KB)