Hi all,

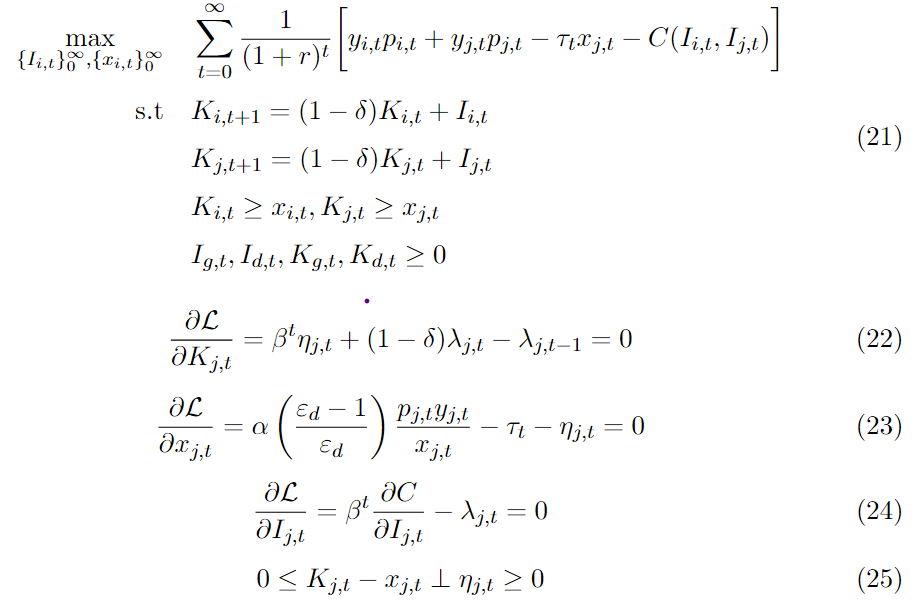

I am trying to implement variable capacity utilization in a two-sector “putty-clay” firm investment model in Dynare. Given a tax on capital in one of the sectors, the profit-maximizing firm might not want to utilize all available capital when faced with a sudden productivity or tax shock. Theoretically, we have complementarity between the capacity constraint and its shadow multiplier, where the latter appears in the inter-temporal firm investment decision. The relevant FOCs, including the complementarity condition, are:

I am relatively new to Dynare, but my understanding is that the go-to way of modeling complementarity is with the OccBin toolkit. The resulting simulations seem fine, except that some of the variables turn negative for certain periods. I assume the negative variables indicate some inconsistency, and my questions are:

- Is it possible to specify some of the variables as positive only?

- Does the use of OccBin in the attached .mod file correctly represent the pen-and-paper complementarity above?

Mod file:

v2.mod (3.8 KB)

Thanks!