Dear Johannes,

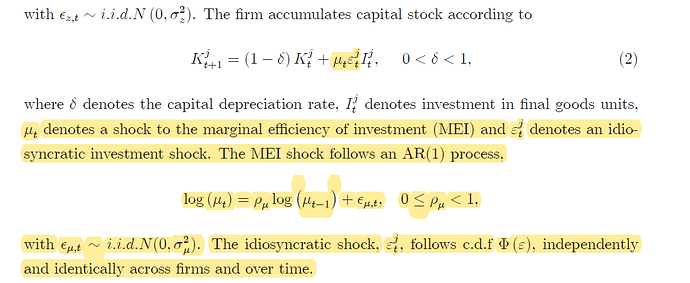

In the DSGE model proposed by Ikeda’s working paper (please refer to the PDF attachment), in the capital accumulation equation, there are two types of investment shocks, one is aggregate marginal efficiency of investment shock, and the other is idiosyncratic investment shock, for this equation, we only observe investment and cannot observe capital stock, consequently, will there be any identification problems to identify marginal efficiency of investment shock (\mu_t) and idiosyncratic shock (I_{t}^j)? I think I_{t}^j will be integrated out in aggregate behavior equation, and in aggregate behavior equation there is only aggregate shock, and aggregate shock \mu_{t} can be identified. What do you thinkMonetary Policy and Inflation Dynamics in Asset Price Bubbles.pdf (843.7 KB)

I don’t see why there should be an identification problem. The idiosyncratic shock plays a separate role from the aggregate one. It enters e.g. equation (12).