I’m bored and fed up with searching for useful DSGE calibration topic and workpaper.

I don’t face any problems with dealing and understanding DSGE model, and how to derivative the model equations, just my problem with caliberation and how to calculate and specify the parameter values

so I need example or full and satisfying explanation like vedios or any useful thing

is an example together with https://sites.google.com/site/pfeiferecon/Chapter_2_RBC.pdf?attredirects=0

Not sure you can just calculate parameter values in DSGE models. You either calibrate them or you estimate them. If you are bored with calibration, maybe it is time to estimate some of your parameters  . There are several estimation options available in dynare.

. There are several estimation options available in dynare.

If you have micro data, you could possibly use applied economics research methods to estimate parameter values yourself (for example, factor shares of production or parameters in the Taylor equation), not sure but maybe that is what you mean by ‘calculate parameter values’.

Since parameter values in calibrated models are based on empirical evidence found by past studies, you obviously have to search for them if you want to fully or partly calibrate your model. So I am not sure you will find a video or text that will show you how to calculate them, I guess. Btw getting bored is part of research, something I heard…

Thank you so much for your reply.

Could you please provide me with

1- The reference for “Chapter_2_RBC.pdf”, I mean the book

2- More of explanations for DSGE Calibration

Because I want to know how to calibrate the parameters, it is the most difficult point to me in DSGE Model

Thank you so much for your reply.

The most difficult I have encountered in DSGE Model is the calibration

So I want understand how to do that and how to calibrate the parameters, and how to do that in Dynare

Hi Moobar,

To calibrate parameters for your model: you have to read the literature and find empirical evidence for the parameter values of your interest. That is, if you don’t have micro data from which you can obtain empirical evidence about the value of a certain parameter yourself. For example, literature says share of labor in output is about 0.7 (at least for developed economies). You can’t calculate that (if you don’t have micro data), you can only find that evidence in the literature and use it in your model.

To do that in dynare, you can find many examples here: https://github.com/JohannesPfeifer/DSGE_mod

Thank you kofiemma

What I have understood from what you mentioned, there are two ways for caliberation

1- If I don’t have an economic data I can use the parameter values from other researches in my model directly

2- If I have an economic data then I can get the parameter values by direct calculating or estimating

So what if I have the two kinds, the parameter values from other and previous researches and an economic data?

I ask this question because I found some of DSGE researches and book using Bayes’ theorem or Bayesian inference

@Moobar This is not part of a book, but of a course I have given at Kobe University. See https://sites.google.com/site/pfeiferecon/teaching

Q: If I don’t have an economic data I can use the parameter values from other researches in my model directly

A: Yes. That is calibrating your model using parameter values based on previous research.

Q: If I have an economic data then I can get the parameter values by direct calculating or estimating

A: Yes, but there are two kinds of data here. If you have MICRO LEVEL DATA, for example, data on firms or households, you can use that to estimate parameter values (outside of the DSGE model) before you use them to calibrate your model , but most at times you don’t have such data, so need to find some evidence about a certain parameter value from the literature. Of course, you may find different micro evidence in the literature about the value of a certain parameter, so you as the researcher should decide whether that value makes sense to you.

Q: So what if I have the two kinds, the parameter values from other and previous researches and an economic data? I ask this question because I found some of DSGE researches and book using Bayes’ theorem or Bayesian inference

A: You have to distinguish between estimating parameter values within the DSGE model using MACRO data and estimating parameter values (outside the DSGE model) using MICRO data. Both are economic data. If you estimate parameter values in the Taylor rule or say the share of labor in output (outside of the DSGE model), using MICRO data and say a regression model, you can only use that parameter to calibrate your model. That is, you tell your model what the values of those parameters are, using the micro-level evidence you found.

You could on the other hand estimate these parameter values within the DSGE model using MACRO data like GDP, AGGREGATE CONSUMPTION. etc, to make your model fit better to the data you have. That is, estimating parameter values within the DSGE model using bayesian methods, maximum likelihood, GMM, etc. In this case, you are not telling your model what these parameters are, you want the model to find them so that your model better fit the data you have. This is when you are doing empirical stuff.

Dear kofiemma

Thank you so much for your wonderful reply.

If you have many examples for caliberation explain how to do it step by step please provide me with even if you have ten’s of different examples to understand caliberation

Thanks again

Dear jpfeifer

About your file Chapter_2_RBC. pdf, it is good, but I need to know the name of variables like

θgt

λt

gt shows up in the government budget constraint, so it is government spending (or government consumption) variable. θ is a utility parameter…you can think of it as controlling how much utility the household gains from consuming gt.

λt is a lagrangian parameter (also called Lagrangian multiplier). It is a standard procedure to maximize the Lagrangian function (i.e., your objective function). It measures how your objective function changes if your constraint changes. Not sure of your background or level, but I think the Lagrangian multiplier is kind of common in economics, both micro and macro.

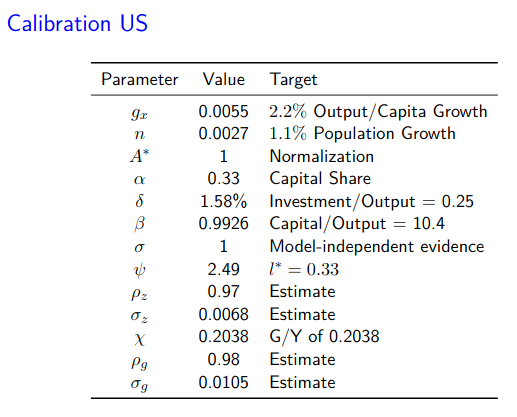

Pretty much, most DSGE models found in (textbooks, research papers, lecture slides, tutorials, etc) have a calibration section of this sort.  . I recommend you read these sections to get more understanding. Like I said before, there is no step by step way to calculate them. Parameter values in a fully calibrated model (like Chapter_2_RBC. pdf) are empirical evidence that researchers have found in observed data, here, for the US economy. For example, using US data, researchers have found that Capital/Output = 10.4. You will find this info only in the literature, of course. Except that you have micro data to estimate it yourself. Btw, for every parameter value you specify in a fully calibrated model, you should kind of be able to explain why you chose that value. Here they choose Capital/Output = 10.4 because researchers have observed that Capital/Output = 10.4 in the US data. And here, they are calibrating the model for the US economy. Hope it makes sense.

. I recommend you read these sections to get more understanding. Like I said before, there is no step by step way to calculate them. Parameter values in a fully calibrated model (like Chapter_2_RBC. pdf) are empirical evidence that researchers have found in observed data, here, for the US economy. For example, using US data, researchers have found that Capital/Output = 10.4. You will find this info only in the literature, of course. Except that you have micro data to estimate it yourself. Btw, for every parameter value you specify in a fully calibrated model, you should kind of be able to explain why you chose that value. Here they choose Capital/Output = 10.4 because researchers have observed that Capital/Output = 10.4 in the US data. And here, they are calibrating the model for the US economy. Hope it makes sense.