Hello, everybody.

How can I calculate and analyze the IRF of the correlation between two variables in Dynare?

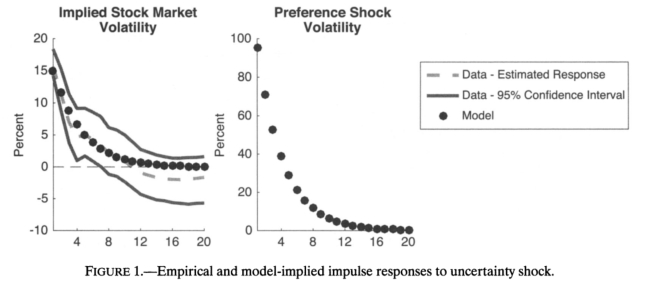

In Basu and Bundick (2017) paper (“Uncertainty shocks in a model of effective demand”), they calculate the IRF of volatility, which is showns as the IRF of model implied stock market volatiltiy.

"

vxo_evola = 100sqrt(4(max(varexpre_evola+varexpre_sss,1e-16)));

vxo_ea = 100sqrt(4(max(varexpre_ea+varexpre_sss,1e-16)));

vxo_ez = 100sqrt(4(max(varexpre_ez++varexpre_sss,1e-16)));

vxo_sss = 100sqrt(4(varexpre_sss));

logvxo_evola = log(vxo_evola./ vxo_sss);

logvxo_ea = log(vxo_ea./ vxo_sss);

logvxo_ez = log(vxo_ez./ vxo_sss);

"

How can I calculate and analyze the IRF of the correlations between endogenous variables, for example, the IRF of the correlation between price of equity and investment ?

Their codes are attached below.

Thanks a lot !

bbeffectivedemandmodelsupportvar.mod (7.9 KB)

irfsss.m (1.9 KB)

sss.m (1.3 KB)