Hi Dear All

In an article, the timing of events is as follows:

Nikolay Hristov.pdf (924.9 KB)

At the end of the previous period:

1-Determining the inputs at the end of the previous period, and determining the amount of the loan and receive it from the bank

At the beginning of the current period:

2- aggregate shock

3- determining good prices

4-idiosyncratic productivity shocks

5-production

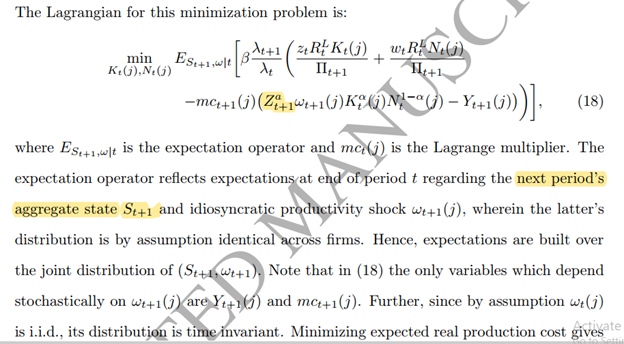

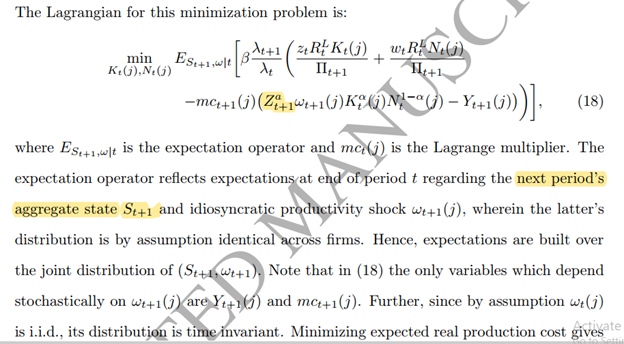

In this model, the following optimization is performed in determining the inputs:

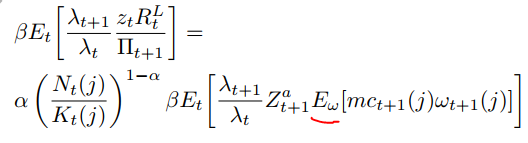

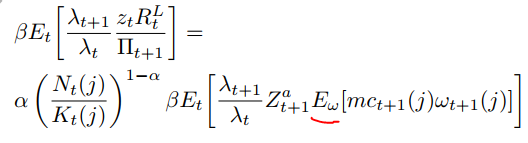

As a result we have:

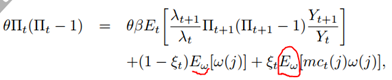

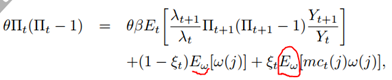

Or in determining the price, we reach the following equation:

My question is whether the existence of an expectation operator over the distribution of idiosyncratic shocks leads to a different coding in the dynare?

I’m sorry, I have a question about this. I’m ashamed to take your time

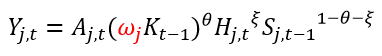

If the timing of my model is as follows:

1-Determining the capital at the end of the previous period

2-Production of goods at the beginning of the current period

3- idiosyncratic shocks to capital quality

This timing has a specific purpose

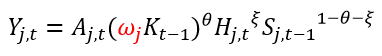

My question is: Is there this idiosyncratic shock in the production function when optimizing and determining K?

We might say : idiosyncratic Shocks occur after the Production of goods ,so it will not exist in the production function. But my question is that the firm does not know exactly when the shock will occur (After the production or before the production)

Usually, you enter the FOCs after aggregation. The posted paper considers a symmetric equilibrium, so the idiosyncratic part can be solved out.