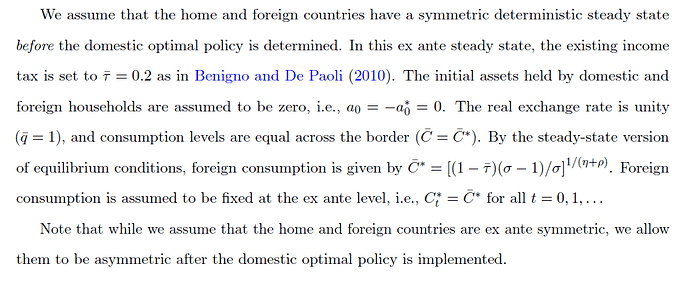

Hello everyone, please tolerate my ignorance. I sometimes saw, in numerical sessions, authors would say like the snapshot below (sorry, usually absence of accommpanied codes…).

I think I know how to compute the Steady State \bar{C}^*=[(1-\bar{\tau})(\sigma-1)/\sigma]^{1/(\eta+\rho)} manually or by dynare, via series of equilibrium conditions at SS.

Then what’s the meaning of the last sentence in 1st paragraph, C^*_t=\bar{C}^* for all t? Does it imply all C^*_t in equilibrium equations are assumed to be constant like a parameter? and in dynare, we can just treat it in parameters session? So what’s the exact meaning of ex ante in the same sentence? How to reflect “ex ante” (and “ex post”) into dynare codes?

Moving back and forth, the author said before policy is implemented, ex ante symmetric; and after policy, two countries can be asymmetric…Sorry very confusing in terms of 1) how to understand them; 2) how to program them in dynare?

=======================

Extra entry-level question: in the same snapshot, the author assumes initial assets a_0=-a_0^*=0. How to set it in dynare? Because I’m often in doubt whether initial conditions are the same as steady states? This doubt appears many many times in my mind, sorry. For example, the following snapshot:

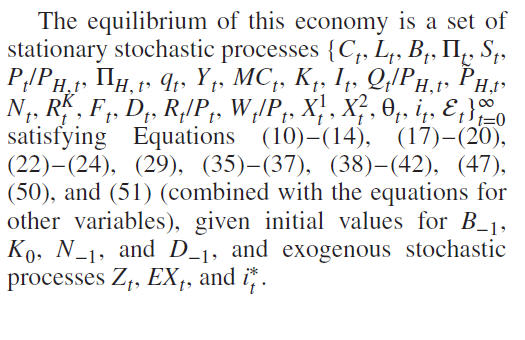

“given initial values for B_{-1}, K_0, N_{-1}, D_{-1}.” How to input them in dynare? or do dynare assign some default values automatically for them?

- Sometimes authors will say, e.g., P_{-1} can be arbitrary, what does “arbitrary” initial condition stand for in dynare?

- Sometimes authors say given initial values for B_{-1}, K_0, N_{-1}, D_{-1} like above, but actually in the paper I never find exact values they set. In this case, how to code in dynare?

- Sometimes authors explicit give initial values, then how to do in dynare?

Very very low level questions, thank you for your patience.