Hi everybody,

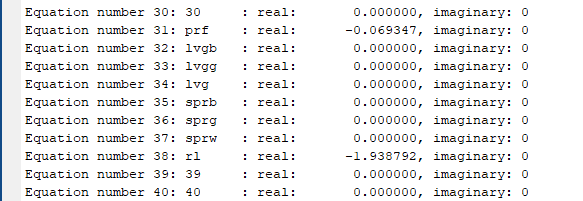

I am building an e-dsge featuring a monopolistic banking sector with two types of loans (brown+green) à la Gerali et al. When computing the steady state, all residuals go to zero except for one equation (net worth on assets equation), and I do not know how to deal with this issue. If anybody would be so gentle to have a look, I would appreciate a lot, thank you!

edsge_ff.mod (5.2 KB)

edsge_ff_steadystate.m (3.6 KB)

findssff.m (2.3 KB)

You set

lvg = iota_w ; %%(nw)/(nw-dep); %%1-(dep/ast);iota_w; %% 1-(dep/ast);

What makes sure that

iota_w 1-(dep/ast);

?

1-\frac{dep}{ast} is just another way to express lvg_{t}=\frac{nw_{t}}{ast_{t}}; \iota_w is the regulatory parameter you have in the adjustment cost at the wholesale level and it equals the steady state value of the capital/asset ratio (ie.what i call lvg), according to the Gerali calibration. This means that at the steady state the wholesale loan rate equals the policy rate because the adjustment cost vanishes (and it vanisches because lvg=\frac{nw}{ast}=\iota_w). can’t understand why leverage equation delivers some residuals while the remaining part of the model does not. Thanks

Given that you have a residual in that equation, it’s obviously not true that

iota_w=1-(dep/ast);

Hence, there must be a mistake somewhere, potentially related to the calibration target.

What do you mean by calibration target? If I changes values of \iota_w residuals reduce and I am able to get them closer to zero by setting a negative value of \iota_w, which does not make sense.

Again, if I set lvg=\frac{nw}{ast} in ss calculation, which does not entails any prior assumption on \iota_{w}, lvg residuals goes to zero, but I have residuals on wholesale foc and bank profits (which contains adjustment costs as a function of lvg-\iota_{w}), as you can see

That means there is an inconsistency between the three affected equations. Check those for errors.

I have defined a variable adj as the sum of all the adjustment costs in the model economy; residuals collapses there. Moreover, I attach a version of the model with no adjustment costs ad the wholesale level (\gamma_w=0, ie the parameter controlling for the size of adjustment = 0), but just sticky rates at the branch level; residual are all zero but still dynare does not deliver a steady state. Can’t understand why.

ff.mod (7.8 KB)

ff_steadystate.m (3.3 KB)

findssff.m (2.3 KB)

In particular, the problem must lie in wholesale adjustment cost (\gamma_{w}=11.49 as in Gerali et al.) as equation for adj displays small positive residual once you add it and so does the wholesale foc for rl. Though, theese equations are right. could the problem lie in the calibration of \gamma_w? I have explored the parameter space but I haven’t come up with values that annihilate residuals.