When I run the model, it indicates that there is 3 colinear relationships between the variables and the equations,but I can not find the problem,although much time have been spent on it. Thanks for your help for all.

In my model ,it contains four sectors : family ,entrepreneur,commercial bank and central bank,the trouble may happens in commercial bank,but the concrete problem can not be found and do not know how to modify the model to solve the problem.

This is my model:

close all;

var L C W K I Y Rk Rd Re e A vp pihash pi mc x1 x2 Rl tau D N ;

predetermined_variables K;

varexo ea eRe etau;

parameters psil psie eta beta delta v gamma zetap mu psim rhoa rhoRe rhotau sigmaa sigmaRe sigmatau psipi psiy;

parameters Ls Cs Ws Ks Is Ys Rks Rds Res es As vps pihashs pis mcs x1s x2s Rls taus Ds Ns ;

psil=1;

psie=1;

eta=1.44018;

beta=0.99;

delta=0.012;

v=2;

gamma=0.4;

zetap=0.75;

mu=2;

psim=0;

rhoa=0.9;

sigmaa=0.1;

rhoRe=1;

sigmaRe=0.1;

rhotau=1;

sigmatau=0.1;

psipi=1;

psiy=1;

%steady state calculation

pis=1;

taus=0.1;

As=1;

Ls=0.64;

Rds=pis/beta;

Res=Rds;

Rks=(1/beta)-(1-delta);

Rls=((1+Rds)/(1-taus))-1;

pihashs=((pis^(1-mu)-zetap)/(1-zetap))^(1/(1-mu));

vps=(1-zetap)*(pis/pihashs)^mu/(1-pis^mu*zetap);

mcs=((1-zetap*beta*pis^mu)/(1-zetap*beta*pis^(mu-1)))*(pihashs/pis)*((mu-1)/mu);

gs=(mcs*gamma/(Rks*(1+psim*Rls)))^(1/(1-gamma));

Ks=gs*Ls;

Is=delta*Ks;

Ws=mcs*(1-gamma)*Ks^gamma*Ls^(-gamma)/(1+psim*Rls);

Ys=(As*(Ks^gamma)*(Ls^(1-gamma)))/vps;

Cs=Ys-Is;

es=((Rds-Res)/(Cs*psie*Rds))^(1/(-v));

x1s=mcs*Ys/(Cs*(1-zetap*beta*pis^mu));

x2s=Ys/(Cs*(1-zetap*beta*pis^(mu-1)));

Ds=(Ws*Ls+Rks*Ks)*(1+psim*Rls);

Ns=((1-taus+Rds)/(1+Rls))*Ds;

model;

%(1) labor supply

psil*exp(eta*L)=exp(W)/exp(C);

%(2) deposit

1/exp(C)=beta*(1/exp(C(+1)))*exp(Rd)/exp(pi(+1));

%(3) home Euler equation

1/exp(C)=beta*(1/exp(C(+1)))*(exp(Rk(+1))+1-delta);

%(4) decp

psie*exp((-v)*e)=(1/exp(C))*(exp(Rd)-exp(Re))/exp(Rd);

%(56) No arbitrary

exp(Rk)+1-delta=exp(Rd);

exp(Rd)=exp(Re);

%(7) resource constraint

exp(Y)=exp(C)+exp(I);

%(8) capital accumulation

exp(K(+1))=exp(I)+exp(K)*(1-delta);

%(9) wage

exp(W)=(1-gamma)*exp(mc)*exp(A)*exp(gamma*K)*exp(-gamma*L)/(1+psim*Rl);

%(10) capital returns

exp(Rk)=gamma*exp(mc)*exp(A)*exp((gamma-1)*K)*exp((1-gamma)*L)/(1+psim*Rl);

%(11) the sticky price equation

exp(pihash)=(mu/(mu-1))*exp(pi)*(exp(x1)/exp(x2));

%(12) the production technology

exp(Y)=exp(A)*exp(gamma*K)*exp((1-gamma)*L)/exp(vp);

%(13) the price dispersion

exp(vp)=(1-zetap)*exp(-mu*pihash)*exp(mu*pi)+exp(mu*pi)*zetap*exp(vp(-1));

%(14) inflation evolution

exp((1-mu)*pi)=(1-zetap)*exp((1-mu)*pihash)+zetap;

%(15) the auxiliary x1

exp(x1)=(1/exp(C))*exp(Y)*exp(mc)+zetap*beta*exp(mu*pi(+1))*exp(x1(+1));

%(16) the auxiliary x2

exp(x2)=(1/exp(C))*exp(Y)+zetap*beta*exp((mu-1)*pi(+1))*exp(x2(+1));

%(17) bank

exp(D)*(1-exp(tau)+exp(Rd))=exp(N)*(1+exp(Rl));

%(18) bank equilibrium

1+exp(Rl)=(1+exp(Rd))/(1-exp(tau));

%(19) technology shock

A=rhoa*A(-1)+ea;

%(20) reserve shock

tau=rhotau*tau(-1)+etau;

%(21) decp rule

(Re/Res)=rhoRe*Re(-1)/Res+(1-rhoRe)*(psipi*(pi/pis)+psiy*(Y/Ys))+eRe;

end;

initval;

L=log(Ls);

C=log(Cs);

W=log(Ws);

K=log(Ks);

I=log(Is);

Y=log(Ys);

Rk=log(Rks);

Rd=log(Rds);

Re=log(Res);

e=log(es);

A=log(As);

vp=log(vps);

pihash=log(pihashs);

pi=log(pis);

mc=log(mcs);

x1=log(x1s);

x2=log(x2s);

Rl=log(Rls);

tau=log(taus);

D=log(Ds);

N=log(Ns);

end;

shocks;

var ea=.01^2;

var etau=.01^2;

var eRe=.01^2;

end;

resid(1);

steady;

check;

model_diagnostics;

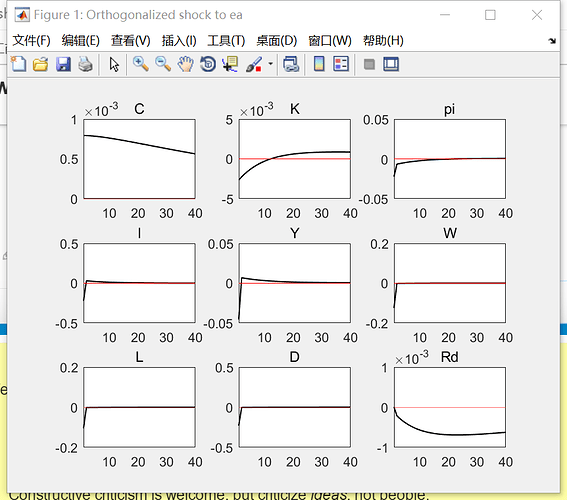

stoch_simul(order=1) Y C I W L K pi D Rd;

These are my results and problems:

dynare D

Starting Dynare (version 5.0).

Calling Dynare with arguments: none

Starting preprocessing of the model file ...

Found 21 equation(s).

Evaluating expressions...done

Computing static model derivatives (order 1).

Computing dynamic model derivatives (order 1).

Processing outputs ...

done

Preprocessing completed.

Residuals of the static equations:

Equation number 1 : -7.691e-07 : 1

Equation number 2 : 0 : 2

Equation number 3 : 0 : 3

Equation number 4 : 0 : 4

Equation number 5 : 0 : 5

Equation number 6 : 0 : 6

Equation number 7 : 0 : 7

Equation number 8 : 0 : 8

Equation number 9 : 0 : 9

Equation number 10 : 0 : 10

Equation number 11 : 0 : 11

Equation number 12 : 0 : 12

Equation number 13 : 0 : 13

Equation number 14 : 0 : 14

Equation number 15 : 0 : 15

Equation number 16 : 0 : 16

Equation number 17 : 0 : 17

Equation number 18 : 0 : 18

Equation number 19 : 0 : A

Equation number 20 : 0 : tau

Equation number 21 : 0 : 21

STEADY-STATE RESULTS:

L -0.446287

C 0.907222

W 0.26449

K 3.22487

I -1.19798

Y 1.02218

Rk -3.81213

Rd 0.0100503

Re 0.0100503

e Inf

A 0

vp 0

pihash 0

pi 0

mc -0.693147

x1 0.778542

x2 1.47169

Rl 0.209812

tau -2.30259

D 0.329028

N 0.172639

EIGENVALUES:

Modulus Real Imaginary

0.75 0.75 0

0.9 0.9 0

0.9361 0.9361 0

1 1 0

1 1 0

1.122 1.122 0

1.238 1.238 0

1.277 -1.277 0

1.347 1.347 0

7.175e+43 -7.175e+43 0

There are 5 eigenvalue(s) larger than 1 in modulus

for 5 forward-looking variable(s)

The rank condition is verified.

MODEL_DIAGNOSTICS: The Jacobian of the static model is singular

MODEL_DIAGNOSTICS: there is 3 colinear relationships between the variables and the equations

Relation 1

Colinear variables:

e

Rl

tau

D

N

Relation 2

Colinear variables:

e

Rl

tau

D

N

Relation 3

Colinear variables:

e

Rl

tau

D

N

Relation 1

Colinear equations

4 6

Relation 2

Colinear equations

21

Relation 3

Colinear equations

20

MODEL_DIAGNOSTICS: The singularity seems to be (partly) caused by the presence of a unit root

MODEL_DIAGNOSTICS: as the absolute value of one eigenvalue is in the range of +-1e-6 to 1.

MODEL_DIAGNOSTICS: If the model is actually supposed to feature unit root behavior, such a warning is expected,

MODEL_DIAGNOSTICS: but you should nevertheless check whether there is an additional singularity problem.

MODEL_DIAGNOSTICS: The presence of a singularity problem typically indicates that there is one

MODEL_DIAGNOSTICS: redundant equation entered in the model block, while another non-redundant equation

MODEL_DIAGNOSTICS: is missing. The problem often derives from Walras Law.

> In dyn_first_order_solver (line 277)

In stochastic_solvers (line 251)

In resol (line 119)

In stoch_simul (line 109)

In D.driver (line 482)

In dynare (line 281)

警告: 矩阵为奇异工作精度。

> In dyn_first_order_solver (line 297)

In stochastic_solvers (line 251)

In resol (line 119)

In stoch_simul (line 109)

In D.driver (line 482)

In dynare (line 281)

警告: 矩阵为奇异工作精度。

MODEL SUMMARY

Number of variables: 21

Number of stochastic shocks: 3

Number of state variables: 5

Number of jumpers: 5

Number of static variables: 11

MATRIX OF COVARIANCE OF EXOGENOUS SHOCKS

Variables ea eRe etau

ea 0.000100 0.000000 0.000000

eRe 0.000000 0.000100 0.000000

etau 0.000000 0.000000 0.000100

POLICY AND TRANSITION FUNCTIONS

Y C I W L K pi D Rd

Constant 1.022176 0.907222 -1.197979 0.264490 -0.446287 3.224870 0 0.329028 0.010050

K(-1) 0 0.861421 0 0 0 0.936084 0.192798 -Inf 0

Re(-1) 0 32.129045 0 0 0 -3.984791 15.120630 -Inf 0

A(-1) 0 0.253816 0 0 0 0.082316 -0.205069 Inf 0

vp(-1) 0 -0.224406 0 0 0 -0.051926 -0.032407 Inf 0

tau(-1) 0 0 0 0 0 0 0 -Inf 0

ea 0 0.078974 0 0 0 -0.157760 -0.91720817520278286072495862254468595712.000000 0

eRe 0 47.320247 0 0 0 14.222771 65.747208-1282818264881313154549164093210624.000000 0

etau 0 0 0 0 0 0 0-23854034316172736.000000 0

All endogenous are constant or non stationary, not displaying correlations and auto-correlations

Total computing time : 0h00m01s

Note: warning(s) encountered in MATLAB/Octave code