I am a beginner and am currently reading a New Keynesian DSGE textbook Understanding DSGE. The benchmark model discussed in the book differs from Gali’s model by introducing capital, but it does not include a Taylor rule. I tried using Dynare code and was able to get results. I also tried removing the capital demand and replacing it with a Taylor rule, and found that I could still get results, but the results were different from before.

My question is, if a unique equilibrium path can be obtained without a Taylor rule, then it means that introducing a Taylor rule in this economic system is ineffective. This is because adding a Taylor rule is equivalent to filtering the equilibrium path. When there is only one path being filtered, either the Taylor rule is meaningless, or it will lead to no equilibrium path being found.

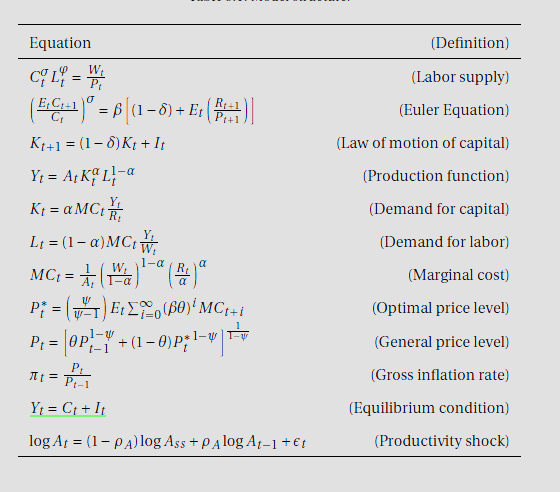

Here are the code and the model:

//NK model - Chapter 3 (UNDERSTANDING DSGE MODELS)

var Y I C R K W L MC P PI A;

varexo e;

parameters sigma phi alpha beta delta rhoa psi theta;

sigma = 2;

phi = 1.5;

alpha = 0.35;

beta = 0.985;

delta = 0.025;

rhoa = 0.95;

psi = 8;

theta = 0.75;

model(linear);

#Pss = 1;

#Rss = Pss*((1/beta)-(1-delta));

#MCss = ((psi-1)/psi)*(1-beta*theta)*Pss;

#Wss = (1-alpha)*(MCss^(1/(1-alpha)))*((alpha/Rss)^(alpha/(1-alpha)));

#Yss = ((Rss/(Rss-delta*alpha*MCss))^(sigma/(sigma+phi)))

*((Wss/Pss)*(Wss/((1-alpha)*MCss))^phi)^(1/(sigma+phi));

#Kss = alpha*MCss*(Yss/Rss);

#Iss = delta*Kss;

#Css = Yss - Iss;

#Lss = (1-alpha)*MCss*(Yss/Wss);

//1-Labor supply

sigma*C + phi*L = W - P;

//2-Euler equation

(sigma/beta)*(C(+1)-C)=(Rss/Pss)*(R(+1)-P(+1));

//3-Law of motion of capital

K = (1-delta)*K(-1) + delta*I;

//4-Production function

Y = A + alpha*K(-1) + (1-alpha)*L;

//5-Demand for capital

K(-1) = Y - R;

//6-Demand for labor

L = Y - W;

//7-Marginal cost

MC = (1-alpha)*W + alpha*R - A;

//8-Phillips equation

PI = beta*PI(+1)+((1-theta)*(1-beta*theta)/theta)*(MC-P);

//9-Gross inflation rate

PI = P - P(-1);

//10-Goods market equilibrium condition

Yss*Y = Css*C + Iss*I;

//11-Productivity shock

A = rhoa*A(-1) + e;

end;

steady;

check(qz_zero_threshold=1e-20);

shocks;

var e;

stderr 0.01;

end;

stoch_simul(irf=40, irf_plot_threshold=0, qz_zero_threshold=1e-20) Y I C R K W L PI A;