I have two .mod files:

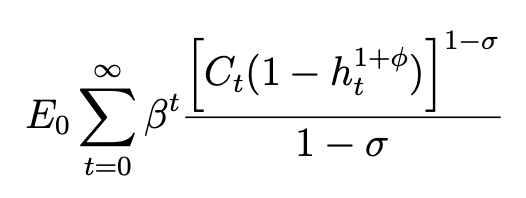

- The first one with a non separable utility function

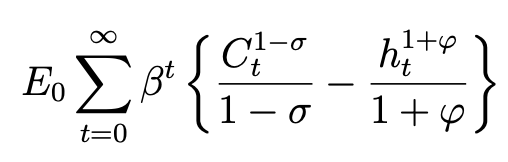

- The second one with a separable utility function

The model is a Neokeynesian with nominal frictions.

Using the same parameters and different utility function, I get the same results in the plots.

Is this possible and normal? Is it a problem of scale?

esercizio1.mod (4.2 KB)

esercizio2.mod (4.1 KB)