MFDF.mod (2.8 KB)

Dear Johannes Pfeifer,

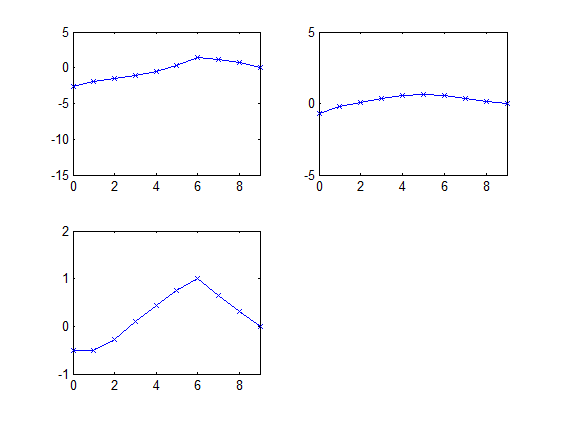

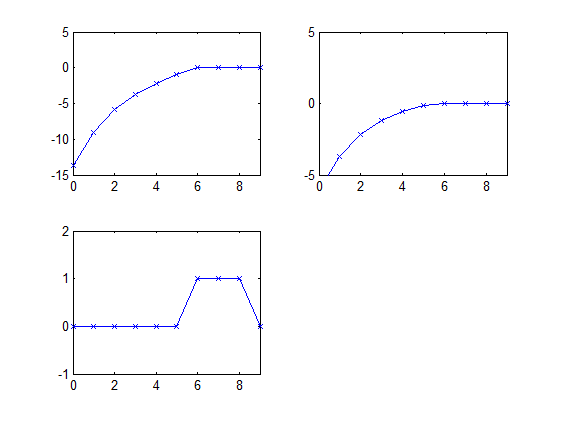

Following the previous correspondence, where figure 5.3 (Gali 2015) is contemplated, I added a few more specifications to a still simple model. Please see the attachment.

The idea is to consider scenarios whereby policy authorities decide to increase spending or cut taxes, after an unexpected negative shock to the natural rate (rn) conducive to a drop in output and a ZLB liquidity trap.

I would like to raise the following questions:

1- When considering three “varexos” within this attachment, Dynare (4.5.1) works fine. When adding a fourth “varexo”, Dynare delivered invariably an error message as detailed in the script (lines 22-24).

2- The number of simulation periods translates into different values of the variables, even though one obtains the message “perfect foresight solution found”. Should some criterion be followed?

3- When considering a debt financed stimulus, using line 55, the results appear to be consistent and the ZLB liquidity trap “respected”, However, when specifying a money financing process using instead line 56, nominal interest rates are (generally) positive. The question thus, is how to incorporate the ZLB liquidity trap in this financing regime?

When you wrote the codes to replicate Gali’s figure 5.3 (2015) under commitment, there is an improvement to the hypothesis obtained under debt financing without commitment, as defined in line 55. My interpretation is that these codes proxy the relevance of forward guidance. Does this mean that if one wants the incorporate the ZLB liquidity trap one has its options restricted? I tried to use your codes (please see lines 58-60), but to no avail. Any suggestions and help, if possible, would be appreciated?

4-Is it possible to overlay graphs using Dynare, say to compare the results under a tax cut or a boost in government spending? An hypothesis is to rely upon Matlab (more user friendly for this purpose), but then the number of periods is at stake as well as the initial and terminal values.

Best regards,

Jose