Hi All,

I am replicating Leeper, Traum, and Walker (2017), “Clearing Up the Fiscal Multiplier Morass,” and studying the determinacy region. Starting from the posterior mean parameters for the 1955:I–2007:IV sample—where the interest rate response to inflation is 1.14 and the government consumption response to debt is 0.21—I gradually lower the interest rate response to inflation to examine when determinacy condition breaks down. I find that the model still yields a unique solution even when the interest rate response falls below 1—for example, at 0.30. In such cases, despite the government consumption responding to debt, should this be interpreted as a fiscal dominant regime?

I would tend to say no. If fiscal policy is still passive, then monetary policy must still be active to get a unique determinate solution.

Hello Professor,

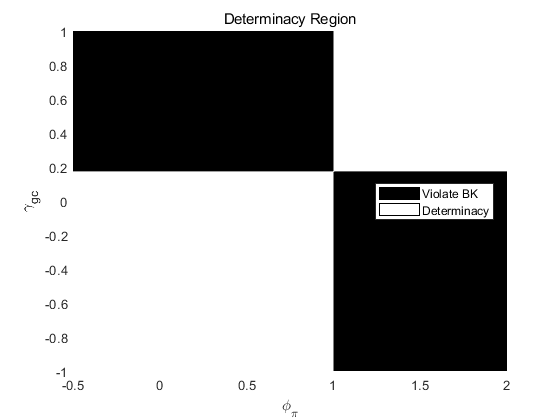

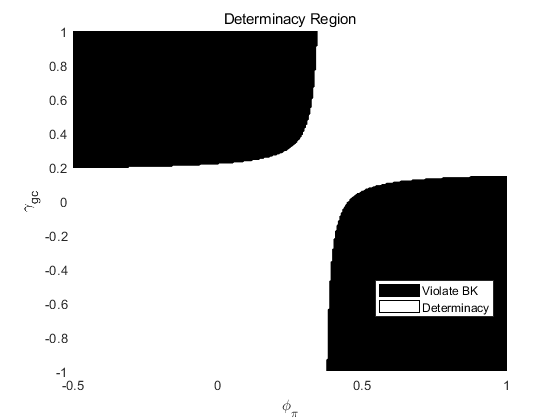

Thanks for your answer. To better understand the results, I plotted the determinacy region using your replication file for Ascari/Sbordone (2014). The left panel shows the case with the monetary policy response to output is zero (phi_y = 0), and the right panel is the case with phi_y = 0.18. With phi_y =0.18, when the government consumption response to debt (gamma_gc) is between 0 and 0.2, a wide range of the interest rate response to inflation(phi_pi) values ensures a unique determinate solution. Would it be reasonable to consider monetary policy as “active” when phi_pi is greater than approximately 0.3, considering the full picture? Also, does this issue commonly arise in other models?

Thanks professor. That makes things much clearer. I really appreciate your help!