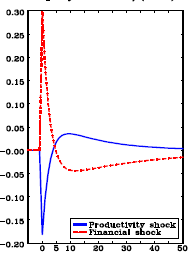

hi! I am reading the paper “Macroeconomic effects of Financial Shocks”.in figure 6, the author reports the irf of financial shock and they say “a positive financial

shock induces a fall in the equity value of firms” but i see the irf first go up and after about 7 periods it becomes negative and then slowly back to the steady state.Also,in figure 7,the author report the irf when there is an investment adjustment cost.i don’t know why the author say it is an increase of equity value. i am now confused about how to explain this type of irf and what is the economic meaning behind it? can you help me out ,thanks a lot!

Do not trust that paper. See https://ideas.repec.org/p/cpm/dynare/050.html and https://github.com/JohannesPfeifer/DSGE_mod/tree/master/Jermann_Quadrini_2012

1 Like

thanks a lot .so,generally how can i explain this type of irf the red one .it’s a increase or decrease? thanks

the red one .it’s a increase or decrease? thanks

It first increases and then decreases. Given the size of the initial spike, I would call it increasing.

1 Like