Hi everyone,

I have a more general question about working with CES consumption functions in New Keynesian models.

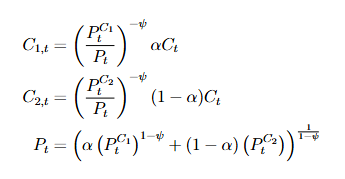

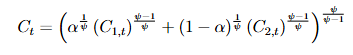

Suppose you have a CES consumption function of the kind underneath, where both goods are flow goods.

In my understanding, one would then set up the Lagrangian and solve the intertemporal optimization problem with respect to ![]() , while also solving an intratemporal allocation problem to obtain the relative demand schedules for

, while also solving an intratemporal allocation problem to obtain the relative demand schedules for ![]() and

and ![]() , as well as the price index of the CES bundle (as shown underneath).

, as well as the price index of the CES bundle (as shown underneath).

This has always worked out fine for me.

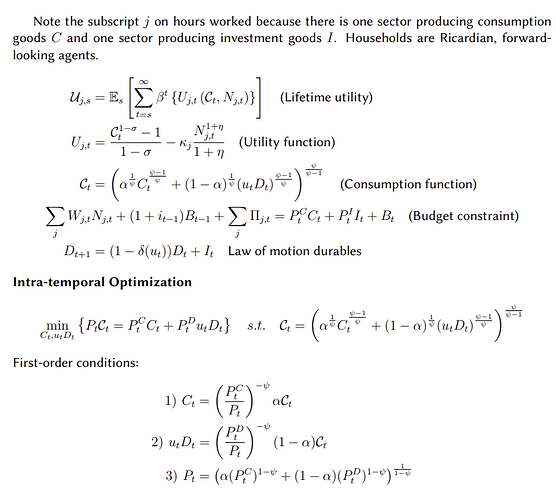

However, I get confused when durables enter the consumption aggregate.

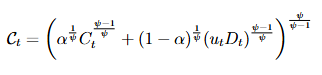

Say the consumption function now takes the following form, where ![]() are nondurable goods (flow goods), and

are nondurable goods (flow goods), and ![]() are services from durables, with

are services from durables, with ![]() denoting utilization.

denoting utilization.

It’s not entirely clear to me how this problem changes.

Some specific questions:

-

What is the price of

? I suppose it is not equal to the price of investing in durable goods, say

? I suppose it is not equal to the price of investing in durable goods, say  . Rather, it might be

. Rather, it might be  ? Or should the relevant price be derived using the multiplier on the accumulation constraint for durables?

? Or should the relevant price be derived using the multiplier on the accumulation constraint for durables? -

Should we still derive the intratemporal allocation problem to obtain relative demand schedules, or is it sufficient to simply solve the Lagrangian directly?

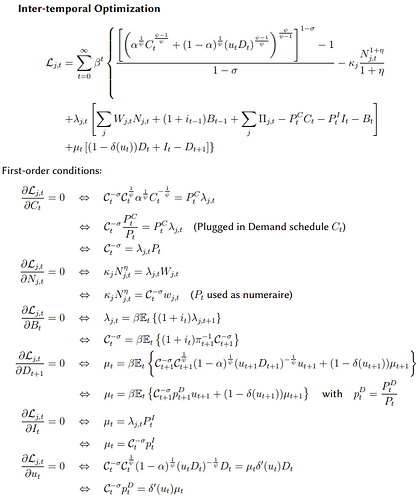

In my current setup, I defined variables and

and  as the derivatives of utility with respect to

as the derivatives of utility with respect to  and

and  , respectively.

, respectively.

I then solved the Lagrangian and substituted in these expressions where needed.

Consequently, I do not have explicit relative demand schedules for and

and  , nor a derived price index of the CES consumption bundle.

, nor a derived price index of the CES consumption bundle.

I simply define inflation as a weighted average of consumption and durable good inflation.

As a sidenote, the model with durables runs fine and behaves reasonably.

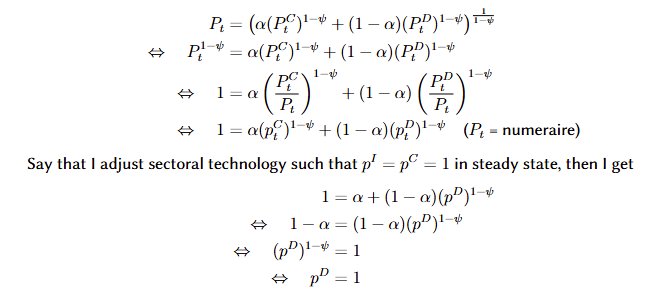

However, to provide some context for my doubt: I have a small open economy, two-sector NK model (where both durables and consumption goods are domestically produced).

When I introduce a negative discretionary income effect after an energy price shock, GDP actually increases, even though domestic consumption falls.

This happens because exports rise disproportionately.

I suspect this might be related to how I treat prices and inflation—if relative prices move too much, exports may react excessively (though other mechanisms could contribute as well).

It doesn’t feel right to continue with this specification until I fully understand whether this CES setup and treatment of prices are conceptually sound.

Any thoughts or references would be very much appreciated!

Best regards,

Alec