@jpfeifer Dear Professor jpfeifer;

In my model, there is a shock to the elasticity of household loans, which makes the loan interest rate fluctuate. But I found that if monetary policy does not respond to loan interest rates, it will not return to a steady state after the shock. Excuse me, can the reaction to loan interest rates be added to the monetary policy? I have read relatively few documents and haven’t found such a setting yet. Thanks for the help of the professor.

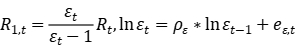

You need to provide more detail. What do the posted equations mean? Why is there a unit root in your model that makes IRFs permanent? Or is the shock permanent?

Professor, here is my model. My problem now is that when my loan interest rate has been impacted and changed, the benchmark interest rate has also changed. What caused this? Can my model be changed to a situation where the loan interest rate changes and the benchmark interest rate remains unchanged? R1hat represents the household loan interest rate. RZhat stands for corporate loan interest rate.EE.mod (2.8 KB)

I am not sure I understand. In response to shocks, of course underlying nominal interest rate based on the Taylor rule will change.

Thank you, Professor. I think so too. But what the model shows doesn’t quite match reality. I think maybe I need to change my model.